KB Kookmin Card Launches Used Car Safe Payment Service

All Major Card Companies Enter Auto Installment Finance Market This Year

Business Diversification Amid Declining Merchant Fee Revenue

[Asia Economy Reporter Ki Ha-young] Competition among credit card companies to dominate the domestic auto installment finance market, valued at 40 trillion won, is intensifying. As the market is being reorganized into a duopoly led by Shinhan Card and KB Kookmin Card, both companies are expanding their services beyond the new car market to the used car market, while small and medium-sized companies are also growing by expanding their assets.

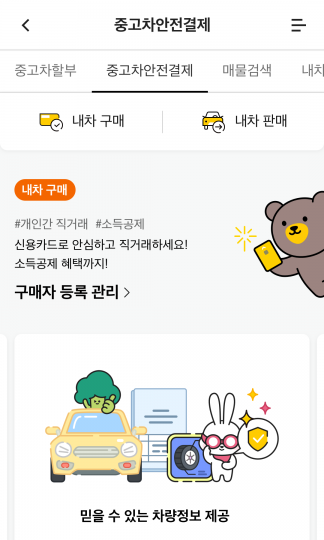

According to the card industry on the 3rd, KB Kookmin Card launched the "KB Kookmin Card Used Car Safe Payment Service" on the same day, which grants sellers one-time merchant status for peer-to-peer used car transactions, enabling payment by credit card. This service was designated as an innovative financial service by the Financial Services Commission in February last year. It provides various convenient services necessary for car transactions all at once, including vehicle price information, insurance accident history, and professional mechanic accompaniment inspections. In particular, through the "payment escrow" service, where the payment is made two business days after the purchase is confirmed, including vehicle title transfer, it reduces transaction uncertainty and risk such as fraud and defective vehicle sales in peer-to-peer transactions.

Seller registration is possible regardless of whether the seller is a KB Kookmin Card member, and buyers can use the service if they hold a KB Kookmin Card credit card. The fee for using the service is 1% of the payment amount. Sellers and buyers each bear 0.5%, and the 0.5% fee borne by the buyer is waived when using linked installment financing. Both sellers and buyers can use the service once a year, and credit card lump-sum payments can be made up to 20 million won.

This year, competition among card companies in the auto installment finance market has become even fiercer. Following Shinhan, KB Kookmin, Samsung, Woori, and Lotte Card, Hana Card has also entered the auto installment finance market, making all major credit card companies handle auto installment finance products.

The duopoly led by Shinhan Card and KB Kookmin Card is also solidifying. According to the Financial Supervisory Service’s Financial Statistics Information System, last year Shinhan Card’s auto installment finance assets were 3.528 trillion won, securing first place, closely followed by KB Kookmin Card with 3.463 trillion won. KB Kookmin Card’s asset size surged 25.2% year-on-year, narrowing the asset gap between the two companies to 65 billion won. Woori Card ranked third with assets of 1.0676 trillion won. Woori Card has accelerated the expansion of its auto finance business by opening a total of 11 specialized auto finance branches?6 last year and 5 this year?bringing the total to 20 branches. Hana Card, which entered the auto installment finance market this year, introduced products such as "Auto Installment," which allows installment repayments for up to 60 months, and "Auto Loan," which offers loans up to 100 million won.

As diversification is necessary to compensate for deteriorating profitability due to reduced merchant fees, competition among credit card companies surrounding the auto installment finance market is expected to intensify. Last year, the auto installment finance revenue of five card companies (Shinhan, Samsung, KB Kookmin, Woori, and Lotte Card) operating in the auto installment finance business totaled 273.1 billion won, a 12.5% increase from the previous year. An industry insider said, "While merchant fee income is gradually decreasing, revenue from the auto installment finance market is increasing," and predicted, "Competition will become even fiercer in terms of securing profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)