①Inevitable Changes in Group Governance Structure

②Risk of Losing 'Aljja' Investment Destinations

③Risk of Acquiring Samsung Electronics Shares

④Capital Market Instability Due to Divestment

[Asia Economy Reporter Oh Hyung-gil] As Lee Jae-yong, Vice Chairman of Samsung Electronics, becomes the largest individual shareholder of Samsung Life Insurance, public attention is once again focused on the National Assembly.

Depending on whether the amendment to the Insurance Business Act, commonly known as the ‘Samsung Life Insurance Act,’ is passed in the 21st National Assembly, there are concerns that it could not only shake Samsung Group’s governance structure but also increase management instability at the country’s top life insurance company and cause major turmoil in the capital market.

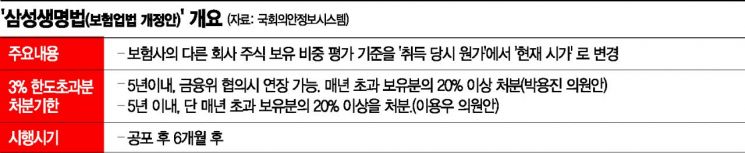

According to the insurance industry on the 3rd, the amendment to the Insurance Business Act proposed by Democratic Party lawmakers Park Yong-jin and Lee Yong-woo aims to change the evaluation standard for the proportion of stocks held by insurance companies in other companies under Article 106 of the Insurance Business Act from ‘acquisition cost’ to ‘market price.’

The purpose is to prevent in advance the transfer of management crises from affiliated companies to insurance companies when the assets held by insurance companies are concentrated in specific affiliates.

Under the current Insurance Business Act, insurance companies can hold stocks and bonds of affiliated companies up to 3% of their total assets. As of the end of last year, Samsung Life Insurance’s total assets amounted to 336 trillion won, of which it holds an 8.51% stake (581,571,148 shares) in Samsung Electronics.

The acquisition cost of Samsung Electronics shares by Samsung Life Insurance in the 1980s was 540 billion won, but when calculated at market price (81,200 won as of 10 a.m. on the 3rd), it amounts to about 41 trillion won. If the amendment passes, Samsung Life Insurance will have to sell Samsung Electronics shares worth 31 trillion won, exceeding 10 trillion won, which is 3% of its total assets.

However, the insurance industry is concerned that if the stocks held are evaluated at market price, variables will arise depending on stock price fluctuations. There are concerns that asset management standards could be destabilized. If Samsung Electronics’ stock price rises or falls further, Samsung Life Insurance would be forced to either purchase additional shares or sell shares, making asset management more complicated.

Globally, only South Korea and Japan separately regulate investment limits for major shareholders or affiliates. When Japan introduced market price evaluation in 2001, it set the evaluation standard for subsidiary and related company stocks at acquisition cost, and for other securities, the lower of acquisition cost and market price.

Samsung Life Insurance can secure huge cash immediately by selling Samsung Electronics shares, but it also faces the problem of losing a valuable investment destination. Last year, Samsung Electronics conducted a special dividend totaling 13.1243 trillion won as part of its shareholder return policy.

NH Nonghyup Securities estimated that Samsung Life Insurance’s dividend income from Samsung Electronics exceeds 980 billion won. The insurance industry widely agrees that, given the recent low-interest-rate environment, the possibility of finding new investment destinations that can generate thousands of billions of won in annual income is virtually slim.

Who will buy Samsung Electronics shares if they are disposed of is also an issue. In the securities industry, a scenario of transferring Samsung Electronics shares to Samsung C&T is being discussed, but Samsung Life Insurance would face tax burdens from capital gains, and Samsung C&T would inevitably face significant costs to finance the share purchase. Considering Samsung Electronics’ status in the domestic stock market, the shock to the market would be unavoidable.

An insurance industry official said, “At first glance, the amendment to the Insurance Business Act may seem like a problem only for Samsung, but from the industry’s perspective, it concerns principles of asset management and institutional rationality,” adding, “Although a seven-year grace period is given after the law’s passage, the immediate socioeconomic impact could be considerable.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.