LTV Limit Regulations for Officetels Expanded to All Financial Sectors

With the introduction of Loan-to-Value (LTV) and Debt Service Ratio (DSR) regulations on non-residential mortgage loans such as officetels, commercial buildings, and land starting this July, attention is focused on how the officetel market, which has recently experienced a boom, will be affected.

Starting from the 17th of next month, LTV limit regulations for officetels, commercial buildings, and land will be expanded and applied across all financial sectors. Currently, a 70% LTV regulation on non-residential mortgage loans is applied only in mutual finance sectors, but this will be extended to all financial sectors. Separately, a 40% LTV regulation will be applied from July on new non-residential mortgage loans in land transaction permission areas.

As regulations on the housing market, such as apartments, have been strengthened, officetels have recently gained popularity as alternative residential products and investment destinations. In particular, residential officetels have been favored by younger generations who lack cash and are interested in home ownership, as loan regulations are relatively more lenient compared to apartments.

Other regulations are also relatively relaxed. Winning a subscription does not count toward the number of houses owned, allowing one to maintain the status of a non-homeowner. Officetel pre-sale rights are not included in the calculation of acquisition tax and capital gains tax on houses. When disposing of pre-sale rights, the capital gains tax rate applied is the basic rate (6%~45%, with a holding period condition of over 2 years).

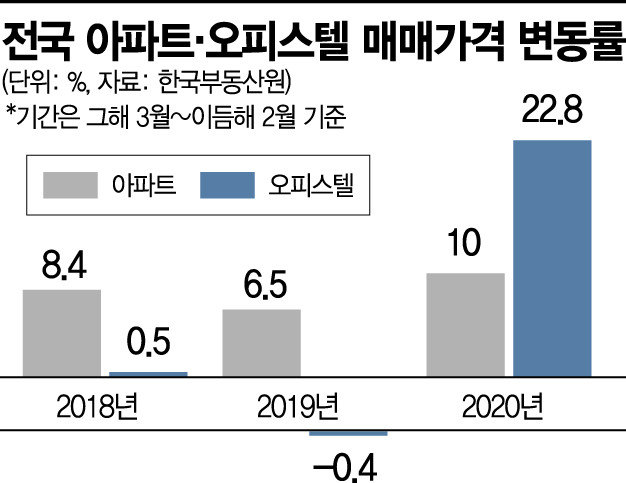

According to the Korea Real Estate Board, as of March, the nationwide officetel sales price increase rate recorded 22.89% compared to the same month last year. This is about 2.3 times higher than the nationwide apartment sales price increase rate of 10% during the same period. Officetel prices, which had a 0.5% increase rate in 2019, showed a decline last year with -0.4%, but have risen more than 20% in just the first three months of this year. Especially in provincial areas, the increase rate reached 33.9% this year.

However, experts predict that the related market may shrink somewhat due to these regulatory measures. The activities of both actual demanders and investors are expected to be particularly restricted.

Researcher Cho Hyun-taek from the Commercial Information Research Institute said, "If the LTV is lowered, investors will need to increase their equity ratio, but since commercial buildings and land are high-priced products, if loan regulations are tightened, transactions will not be as active as before."

It is expected that the officetel market in major commercial districts will be relatively heavily impacted by the 40% LTV regulation on new non-residential mortgage loans in land transaction permission areas.

Researcher Cho explained, "Considering that popular officetels are concentrated in land transaction permission areas such as Gangnam and Seocho districts, some contraction in the officetel market is expected," adding, "There is also a possibility that prices may fluctuate in the short term due to demand trying to purchase in advance while loans are still available."

However, the government believes that the actual demand segment for officetels will not be significantly affected by the regulations. In response to a question suggesting that non-residential mortgage loan regulations might make it difficult for young people, who mainly use officetel mortgage loans, the government official answered that this is not the case.

Lee Se-hoon, Director of the Financial Policy Bureau at the Financial Services Commission, stated, "The purpose of the non-residential mortgage loan regulations is to prevent excessive LTV application or loans beyond repayment capacity by exploiting loose regulations," adding, "For typical officetel mortgage loans for actual demand, where reasonable LTV levels were applied according to financial institutions' internal rules, we believe there will be no significant change in housing burden."

Director Lee added, "More than 90% of borrowers will not feel changes due to the introduction of individual DSR," but "speculative demand that has excessively borrowed to invest in real estate and other assets is expected to be greatly affected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.