[Asia Economy Reporter Jeong Hyunjin] As the United States, focusing on the global supply chain restructuring, plans to announce the results of its review of the supply chains for four major items including semiconductors and batteries in June, an analysis has emerged that if the Biden administration’s semiconductor support intensifies, South Korea will be the country hit hardest after China. Accordingly, experts suggest that the South Korean government should utilize the upcoming Korea-US summit at the end of next month as a strategic opportunity to 'minimize damage and maximize national interests.'

The Federation of Korean Industries (FKI) held an expert roundtable on the 29th titled "100 Days Since the Biden Administration’s Inauguration: US Global Supply Chain Restructuring Policy and South Korea’s Response Direction." Industry experts in semiconductors, batteries, resources, and active pharmaceutical ingredients related to President Joe Biden’s executive order reviewing the supply chains of four major industrial items participated in the discussion on the background of the executive order, the current status of global supply chain reconstruction, and South Korea’s response measures.

At the meeting, an analysis was presented that if the US intensifies support for the semiconductor industry, South Korea will suffer significant impact following China. Cho Kyung-yeop, Director at the Korea Economic Research Institute, in his presentation titled "Analysis of South Korea’s Industry-Specific Impact and Response," stated, "The fundamental purpose of this executive order is to secure US leadership in advanced industries and to build and restructure a US-centered supply chain to curb China’s rise," adding, "In the mid to long term, it is highly likely that the US will urge allied countries such as South Korea, Taiwan, and Japan to invest and participate in the US-centered supply chain restructuring strategy."

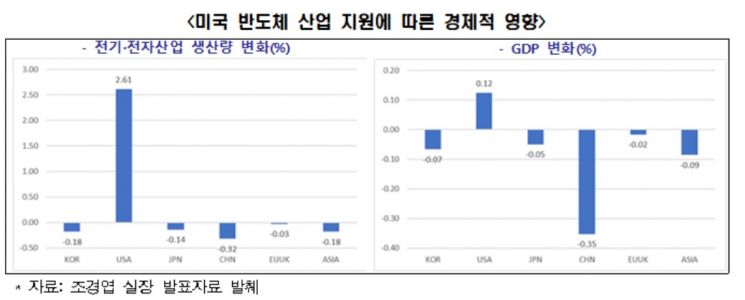

Director Cho said, "When estimating the economic impact of US semiconductor industry support, South Korea’s GDP decline was the second largest at -0.07%, following China at -0.35%. In the electrical and electronics industry, which includes semiconductors, South Korea’s production volume decreased by -0.18%, making it the second most affected country after China (-0.32%)."

In a discussion chaired by Park Tae-ho, Director of the Kwangjang International Trade Research Institute and former Head of the Trade Negotiations Office at the Ministry of Foreign Affairs and Trade, experts on the four key industries covered by the Biden administration’s executive order participated to forecast the contents and explore countermeasures. Professor Kim Yong-jin of Sogang University said about the US supply chain strategy, "As digital technology advances, the movement of raw materials and market-centered production will become more active than goods," adding, "Countries like South Korea, which produce intermediate goods, may be forced to choose from countries that hold markets, so it is time for us to consider restructuring our industrial structure to explore areas where Korea can lead value chain construction."

Lee Joo-wan, Research Fellow at POSCO Research Institute specializing in semiconductors and batteries, said, "Currently, from a market perspective, China is the largest market for semiconductors, and Europe is the largest for batteries and materials. If investments are made in the US instead, certainty about demand is necessary," adding, "Investments at a level that can maintain operating rates based solely on US demand seem appropriate." He emphasized the need for detailed analysis of local market size and demand.

Professor Lee Hyo-young of the Korea National Diplomatic Academy, in a presentation titled "Current Status of the Biden Administration’s Global Supply Chain Restructuring Policy," said, "Global supply chain restructuring has been ongoing due to changes in the international trade environment and technological development, but the COVID-19 pandemic has made visible the risks related to health, national, and environmental security, which are being used as external justifications to promote large-scale industrial policies," adding, "The US may also pursue reforms of international trade rules such as the WTO Government Procurement Agreement (GPA) if necessary."

Meanwhile, Kim Bong-man, Director of International Cooperation at the FKI, said, "Amid the COVID-19 pandemic and US-China conflicts, as both countries strengthen their own-centered global supply chains, South Korea has found itself in a difficult position," adding, "To prevent a recurrence of situations like when the US included its ally South Korea in export restrictions, our government needs a vision and strategy for bilateral trade relations that can maximize benefits and minimize damage for Korea at the Korea-US summit scheduled for the end of next month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.