[Asia Economy Reporter Park Jihwan] Short selling will resume from the 3rd of next month, approximately 1 year and 2 months after being banned due to the market crash caused by COVID-19 in March last year.

On the 29th, the Financial Services Commission announced that short selling will be resumed from May 3rd, limited to KOSPI 200 and KOSDAQ 150 stocks. Previously, the Financial Services Commission banned short selling on all stocks for six months starting in March last year when stock prices plummeted due to the COVID-19 crisis, and subsequently extended the ban twice.

The KOSPI 200 and KOSDAQ 150 indices consist of stocks with large market capitalization and abundant liquidity. The Korea Exchange selects stocks meeting certain criteria such as industry group, cumulative market capitalization, and average daily trading volume in June and December, and announces the selection results two weeks prior to the change date.

The financial authorities decided to resume short selling in February and have been working with related organizations such as the Korea Exchange to improve the system by strengthening penalties for illegal short selling and expanding accessibility for individual investors.

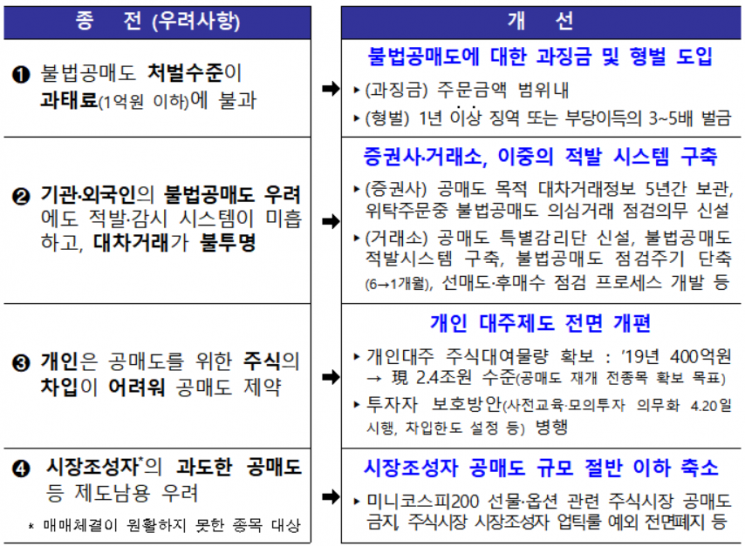

Through legal amendments, from the 6th of this month, penalties for illegal short selling have been enhanced from fines to include surcharges and criminal penalties. Additionally, a dual detection system for illegal short selling by securities firms and the exchange has been established.

Last month, the market maker system was also reformed. Market makers are designated securities firms that provide liquidity by quoting buy and sell prices for stocks with low trading activity. The Financial Services Commission reduced the scale of short selling by market makers to less than half of the current level and completely abolished the uptick rule exemption for stock market makers (a system that requires short sale prices to be at or above the last transaction price).

Participation of individual investors in the short selling market, which had been criticized as a tilted playing field, has also been significantly expanded. Although individuals could short sell by borrowing stocks through the lending system, actual stock borrowing was difficult, resulting in minimal participation. As of February last year, only six securities firms provided lending services, covering 393 stocks and 20.5 billion KRW, making practical participation challenging. Accordingly, the Financial Services Commission expanded the number of securities firms offering lending to 28 and increased the lending target to all stocks in the KOSPI 200 and KOSDAQ 150, totaling approximately 2.4 trillion KRW, greatly enhancing individual investors' access to short selling.

Investor protection measures have also been established. To engage in short selling, investors must complete prior education and simulated trading courses, and trading is allowed only within borrowing limits set by securities firms based on the investor's short selling experience.

The Financial Services Commission stated, "Together with the Financial Supervisory Service and the Korea Exchange, we will closely monitor market trends after the resumption of short selling and maintain a rapid response system. Stocks with concerns of increased volatility due to a surge in short selling will be promptly designated as overheated short selling stocks to quickly block factors causing market instability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.