Synergy Among Banks, Securities, Insurance, and Card Sectors Gains Importance Amid Prolonged Ultra-Low Interest Rates

Non-Bank Sector Profit Share Soars

[Asia Economy Reporter Park Sun-mi] As the synergy among financial sectors such as banks, securities, insurance, and cards becomes more important in the ultra-low interest rate era, the notion that the performance of financial holding companies is led by banks has become a thing of the past. With it becoming clear that the stronger the non-bank affiliate portfolio in the first quarter of this year, the better the overall performance of the holding company, the diversification efforts of the four major financial holding companies toward non-bank sectors are expected to accelerate further.

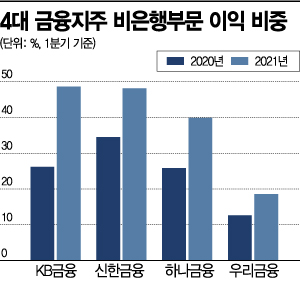

According to the financial sector on the 29th, the profit share of the non-bank sector in the first quarter results of the four major financial holding companies this year increased significantly compared to a year ago. The company with the largest non-bank sector share was KB Financial Group at 48.6%, followed closely by Shinhan Financial Group at 48.1%. Nearly half of the two holding companies' profits come from non-bank sectors. Hana Financial Group and Woori Financial Group recorded 39.9% and 18.6%, respectively.

During this period, KB Financial Group's non-bank sector profit share rose by 22.4 percentage points compared to the same period last year, while Shinhan, Hana, and Woori also increased by 13.6, 14.1, and 6 percentage points, respectively. The increasing share of non-bank affiliates in total profits has become a common trend across the financial industry.

This aligns with the financial sector trend where, due to the low interest rate environment, increasing fee income contributed by non-bank affiliates has become more important than interest income, which is mainly contributed by banks, in the overall profit structure of financial holding companies.

In the case of KB Financial Group, which posted the highest quarterly profit ever, net interest income increased by 12.5% compared to a year ago, while net fee income rose by 44.3%. The share of non-bank sectors in net fee income expanded from 57.7% in the first quarter of last year to 67.4% in the same period this year. Similarly, Shinhan Financial Group's bank-centered interest income increased by 5.7% compared to a year ago, while the non-interest income from cards, securities, and capital increased by 40.4%. Woori Financial Group, which lacks securities and insurance, saw its interest income increase by 10.7%, but non-interest income only rose by 16.9% due to its relatively weak non-bank portfolio.

Growing Importance of Non-Bank Portfolios

The breakdown of boundaries between financial sectors has also played a role in dispersing profit contributions that were concentrated in banks to non-bank affiliates. Currently, the financial industry is shifting from operating separate branches by sector?banks, securities, insurance?to increasing the operation of complex financial branches where customers can manage their assets all at once. For example, a combined bank and securities branch prevents bank customers from moving to other nearby securities firms to subscribe to investment products and connects bank customers to non-bank affiliates under the same brand.

As customer demand grows to manage different asset types comprehensively in one place, it has become important for financial companies to strengthen their non-bank portfolios and create synergy across sectors.

Shinhan Financial Group Chairman Cho Yong-byeong’s establishment of the group’s mid-term strategy ‘Fresh 2020s’ last year, emphasizing growth centered on non-interest, non-bank, and matrix businesses, is based on this background. KB Financial Group Chairman Yoon Jong-kyu is also looking beyond strengthening non-bank portfolios through mergers and acquisitions (M&A) to enhancing the group’s non-financial businesses by growing non-financial platforms such as automobiles, real estate, healthcare, and telecommunications.

The financial industry expects the low interest rate trend to continue for the time being, limiting profits from bank interest margins, so efforts to improve non-bank portfolios to boost the performance of the non-bank sector will continue. A banking official said, "In the past, banks were the ‘flower’ of financial groups, but now the financial group’s performance depends on how much non-bank affiliates advance," adding, "In the future, efforts to improve weak non-bank portfolios by each financial holding company will become active, and competition for M&A will intensify in the process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)