Digital Non-Life Insurers May Be Established Within the Year

MyData Review Also Gradually Accelerating

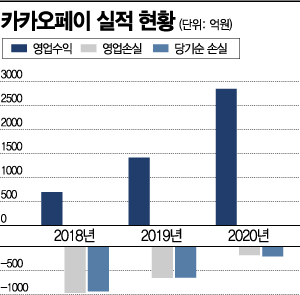

[Asia Economy Reporter Kiho Sung] Kakao Pay is stepping up its efforts toward listing. The green light has been given for the long-awaited personal credit information management (MyData) business license, and the preliminary approval review for establishing a digital non-life insurance company, which had been at a standstill, is also gaining momentum. Expectations for Kakao Pay's year-end initial public offering (IPO), now entering the listing process, are rising further.

According to the financial sector on the 28th, the MyData business review, which had been on hold, is expected to be unshackled soon. MyData is one of Kakao Pay's long-cherished projects. Although Kakao Pay applied for preliminary approval for MyData in December last year, it encountered obstacles due to issues regarding the major shareholder eligibility of Alipay Singapore Holdings, an Ant Group affiliate holding 43.9% of the shares. At that time, financial authorities sent a letter to the People's Bank of China to inquire whether Alipay had been subject to any legal sanctions but received no response, leading to a suspension of the review. Recently, the Financial Services Commission and the Financial Supervisory Service have reportedly been engaging with Chinese authorities through multiple channels.

Once the major shareholder eligibility issue is resolved, Kakao Pay is expected to resume MyData-related services promptly. The MyData review period consists of a two-month preliminary review and a one-month main review, but if all facility and personnel requirements are met, the process can proceed directly to the main review and be completed within one month. Financial authorities have stated they will accept MyData review applications monthly.

Kakao Pay is also preparing to launch an insurance company. As early as the end of this year, the first digital non-life insurance company combining ICT and insurance from a big tech (large information and communication company) is expected to be launched.

Previously, Kakao Pay attempted to establish a digital non-life insurance company jointly with Samsung Fire & Marine Insurance in 2019, but the plan fell through due to differing opinions. Subsequently, in December last year, Kakao Pay applied for preliminary approval for a comprehensive non-life insurance company and embarked on an independent path to establish a digital non-life insurer. Upon receiving preliminary approval, Kakao Pay must meet insurance business licensing requirements within six months to apply for final approval. If the approval process proceeds smoothly, industry observers expect the Kakao Pay digital non-life insurance company to launch by the end of this year.

Market Value Over 10 Trillion Won... Growing Expectations for IPO

The listing process is also progressing smoothly. On the 26th, Kakao Pay submitted a preliminary review application for listing to the Korea Exchange's KOSPI Market Division. Considering that the preliminary review period typically takes about two months, Kakao Pay is expected to pass the review and enter the IPO process as early as the end of June. The lead underwriter is Samsung Securities.

Internally, Kakao Pay values the company at up to 17 trillion won upon listing. According to the securities industry, when Kakao Pay filed for the preliminary review, the planned public offering amount and desired offering price were disclosed. Currently, the underwriter has requested corrections, and the related information has been removed.

According to the disclosed information, the issue price per share ranged from 73,700 to 96,300 won, and the planned public offering amount was between 1.474 trillion and 1.926 trillion won. The number of shares to be listed is 133,367,125 shares, making the market capitalization immediately after listing between 9.829 trillion and 12.843 trillion won. Considering that the offering price is usually calculated with a 20-40% discount, the company value Kakao Pay envisions reaches up to 17 trillion won.

In the market, even with conservative estimates, considering this year's trend where mega IPOs often set their offering price above the upper limit, the consensus is that Kakao Pay will be recognized with a corporate value exceeding 13 trillion won. This surpasses the market capitalization of Hana Financial Group, which stood at 13 trillion won as of the 28th. Initially, the securities industry had projected Kakao Pay's expected corporate value could reach up to 18 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.