2021 Asset Management Trend Changes

Analysis by Hana Financial Research Institute

A study has found that due to increased market volatility caused by the impact of COVID-19, wealthy individuals have shown a stronger tendency toward investing in safe assets and diversifying their investments. It has also been pointed out that financial companies need to provide services that focus more precisely on individual investors to match these diversified investment behaviors.

On the 29th, according to the financial sector, Ha Seo-jin, Senior Researcher at Hana Financial Management Research Institute, analyzed in the recently released report "2021 Asset Management Market Trend Changes" that "due to the influence of COVID-19, the preference for safe assets has strengthened, leading high-net-worth individuals to increase their holdings of cash and cash equivalents while diversifying their assets across various direct and indirect investment products."

He diagnosed that as the demand for diversification increased, the proportion of indirect investments such as funds among high-net-worth individuals expanded, and asset management companies, which have recently been struggling with rising customer churn rates, are showing increased interest in offering related products.

Among domestic asset management companies, 69%?equivalent to 7 out of 10 firms?responded that the recently heightened market volatility and COVID-19 negatively affected customer retention rates, and 67% said this trend increased demand for various fund products.

The proportion of overseas investment assets among high-net-worth individuals has also expanded. According to the report, high-net-worth individuals showed strong interest in non-residential (commercial) real estate as a major overseas investment asset. Senior Researcher Ha explained that the growth of non-residential assets in countries such as the United States, Japan, Switzerland, and Spain was particularly notable.

Some securities firms have recently accelerated their response by increasing personnel in their overseas real estate investment sales divisions. The general view is that this movement will accelerate further once the global COVID-19 pandemic situation subsides due to widespread vaccination.

High-Net-Worth Individuals Actively Adjusting Investment Portfolios

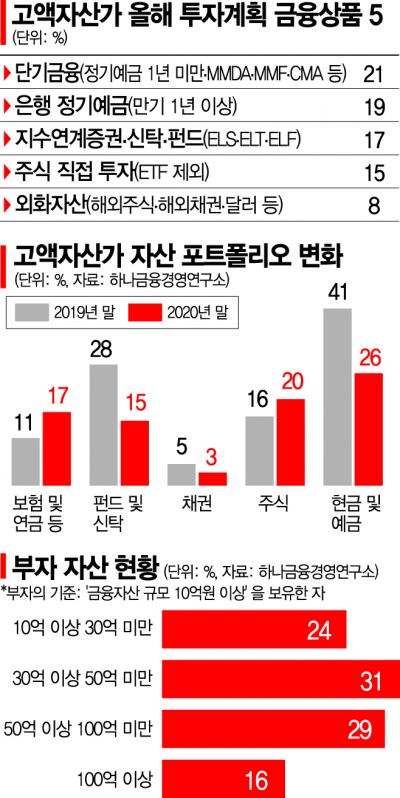

The adjustment of wealthy individuals’ investment portfolios due to COVID-19 was also highlighted in the "2021 Korean Wealth Report," also known as the "Rich Report," released by the research institute last month. It noted that the mass affluent with financial assets exceeding 100 million KRW and the wealthy with assets over 1 billion KRW are actively changing the composition of their financial assets.

According to the report, the stock ratio of these groups, which was 16% at the end of 2019, increased to 20% by the end of last year, and the proportion of insurance and pensions also rose from 11% to 17%. The cash ratio increased from 41% to 46%, supported by a strong preference for bank time deposits and short-term financial products.

When the research institute surveyed the "Top 5" financial products in the investment plans of wealthy individuals for this year, short-term financial products and bank time deposits ranked highest at 21% and 19%, respectively.

High-net-worth individuals also showed strong interest in overseas stock investments. They are reducing the proportions of foreign currency deposits (55%, multiple responses) and foreign currency cash (50%, multiple responses) while increasing investments in overseas stocks (25%, multiple responses) and foreign currency ETFs (10%, multiple responses).

Senior Researcher Ha predicted that in this environment, providing personalized asset management services based on digital platforms will become increasingly important to retain existing customers and attract new ones.

He also anticipated that a "multi-channel" approach, communicating with customers not only through face-to-face consultations but also via online, mobile, and video calls, will become common in the asset management business.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)