[Asia Economy Reporter Joselgina] The global smartphone market, which had frozen due to the COVID-19 pandemic, is expected to enter a full-fledged 'super cycle' led by 5G starting this year. Two years ago, the first year of commercialization, the global shipment volume of 5G smartphones was only around 16 million units, but this year it is expected to approach 600 million units. Major manufacturers such as Samsung Electronics, Apple, and Xiaomi are releasing a variety of 5G smartphones ranging from mid-range models priced in the 100,000 KRW range to foldable form factors.

◇This Year’s 5G Smartphone Shipments ‘Jump Up’

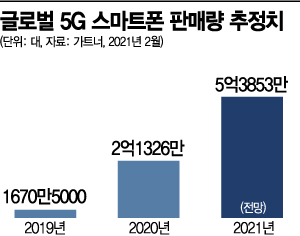

According to market research firm Strategy Analytics (SA) on the 28th, global 5G device (smartphones + feature phones) shipments are estimated to reach 600 million units this year. Another market research firm, Gartner, also forecasts that the annual shipment volume of 5G smartphones will increase significantly from 213.26 million units last year to 538.53 million units this year. Considering that the number of units sold in the first year of 5G commercialization was around 16 million units, this is a clear growth trend. Gartner stated, "With the continued release of mid-range 5G smartphones, 5G smartphones have gained 'momentum' in all regions this year," and predicted that "5G will account for 35% of total smartphone sales."

In particular, the so-called ‘5G migration’ that had been limited to some leading 5G countries such as Korea, the United States, and China until last year, the second year of commercialization, is expanding worldwide, which supports expectations for the super cycle. The release of affordable 5G smartphones priced between 100 and 200 dollars and the increased availability of 5G networks in various countries are expected to drive market maturity.

This trend is especially evident in China, the world’s largest smartphone market. The 5G smartphone market share in China is expected to expand to 59.5% this year. David Kerr, a researcher at SA, said, "Last year, global 5G devices recorded 1350% growth centered on the Chinese market," and predicted that this trend will continue this year. The combination of economic recovery from COVID-19 and demand for smartphone replacement along with the spread of 5G is expected to result in double-digit growth in total global smartphone shipments this year.

◇From Mid-Range 100,000 KRW Smartphones to Foldables

Consumers’ choices for 5G devices have greatly expanded, from smartphones priced in the 100,000 KRW range to foldable phones. In the first year of commercialization, only seven 5G device models were released, and prices far exceeded 1 million KRW. However, in the Korean market, known as the ‘graveyard of foreign phones,’ there are currently 30 to 40 types of 5G-based smartphones on sale.

In particular, Apple’s first 5G smartphone, the iPhone 12, released globally in the second half of last year, is regarded as a turning point for full-scale 5G migration. Samsung Electronics also attracted attention by launching the Galaxy S21 early this year as the first 5G flagship priced below 1 million KRW. The company is also strengthening its A series lineup, including the Galaxy A52 5G, which offers flagship performance at a mid-range price. Samsung Electronics is expected to soon release the Galaxy A42 5G, Galaxy A32 5G, and Galaxy A22 5G.

The form factor battle, including foldables, is also expected to contribute to the 5G-led super cycle. Following Samsung Electronics, Huawei, Xiaomi, and Apple are joining the competition, which is expected to become more intense. Huawei, which unveiled its third foldable phone 'Mate X2' in February, plans to release three additional foldable smartphones in the second half of the year. It is reported that these will be priced more affordably to compete with Samsung Electronics’ Galaxy Z Flip and Z Fold successors. If Apple, which is also reportedly considering foldable devices, joins the market, the related market growth is expected to be even more explosive.

An industry insider said, "As the existing bar-type smartphone market reaches saturation, the importance of various form factors and technological innovation such as foldables is increasing," and predicted, "5G-based form factors will lead a big cycle that will dominate the smartphone market in the future."

However, the possibility that COVID-19 could again negatively impact the smartphone supply chain cannot be ruled out. COVID-19 is resurging mainly in India and Brazil recently, posing downside risks. The industry initially expected a 5G-led super cycle starting from last year, the second year of commercialization, but the unexpected pandemic dealt a blow to the overall market. The semiconductor shortage caused by the chip crisis is also cited as a key issue.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.