Attractive Factors Including Abundant Liquidity, Investor Base, and Lenient Listing Regulations

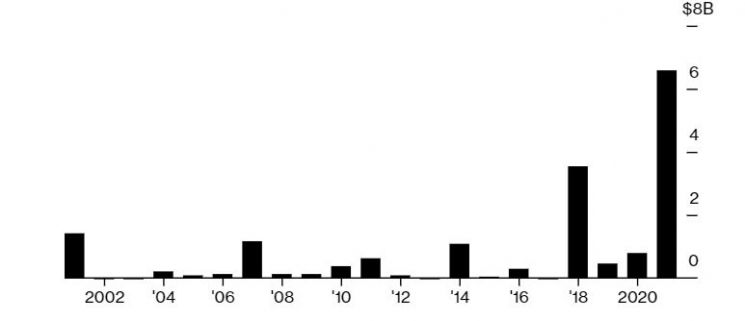

[Asia Economy Reporter Yujin Cho] According to Bloomberg News on the 25th (local time), Chinese companies have raised $6.6 billion through initial public offerings (IPOs) on the U.S. New York Stock Exchange so far this year.

The amount raised is about eight times higher compared to the same period last year, marking an all-time record. There are also forecasts that this year's IPO volume will surpass last year's record and set a new annual high.

The largest Chinese company by IPO size in the U.S. this year is the e-cigarette manufacturer RLX, which raised $1.6 billion, followed by software company Tuya with $947 million.

Last year, Chinese companies raised $15 billion through U.S. IPOs, the highest level since Alibaba alone raised $25 billion in 2014.

This year, China's largest ride-sharing company Didi Chuxing has filed an IPO application with the U.S. Securities and Exchange Commission (SEC).

If Didi Chuxing's listing is successful, it will be the second-largest U.S. listing by a Chinese company since Alibaba in 2014. According to U.S. data provider PitchBook, Didi Chuxing's post-IPO valuation is estimated at about $62 billion, with experts projecting it could reach up to $100 billion.

According to sources, truck-sharing startup Manbang is preparing for a U.S. listing worth $2 billion.

As tensions between the U.S. and China deepen and following the accounting fraud case of Luckin Coffee, once dubbed the "Chinese Starbucks," U.S. authorities have tightened regulations on Chinese companies.

The U.S. Congress is pushing legislation that would allow the removal of Chinese companies from U.S. securities markets if they fail to comply with U.S. accounting standards audits. Until now, Chinese companies have been exempt from audits under the 'U.S.-China Audit Agreement' signed in 2013 and have been audited by China's financial regulatory authority, the China Securities Regulatory Commission.

If Chinese companies fail to comply with the stricter regulations, their listings on the New York Stock Exchange or Nasdaq could be canceled.

Despite these risks, Chinese companies insist on listing in New York due to abundant liquidity, a broad investor base, and flexible listing rules that are less dependent on performance.

In particular, technology-based companies such as fintech firms are flocking to the U.S. because of the simplified listing process and openness to companies operating at a loss.

Stephanie Tang, head of Greater China private equity at Hogan Lovells, said, "While U.S. sanctions on Chinese companies could be a negative factor for Chinese IPOs in the U.S., these risks will not deter Chinese companies from heading to New York. The trend of Chinese companies pursuing U.S. IPOs is expected to continue in the second half of this year and next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)