As the United States accelerates investment in renewable energy, interest in domestic solar-related companies is also increasing. The Joe Biden administration has declared carbon neutrality by 2050 and announced plans to significantly increase investments in renewable energy such as solar power. Developed countries including the European Union (EU) and China are also joining efforts to expand the share of renewable energy to address climate issues. Additionally, with the U.S. showing moves to impose sanctions on polysilicon produced in the Xinjiang Uygur region, it is expected to create opportunities for other polysilicon manufacturers. Could this become a springboard for a resurgence for domestic polysilicon leaders like OCI and Hyundai Energy Solutions, which produces solar cells and modules, after a prolonged slump? We take a closer look at the management status of these two companies and assess their future growth potential.

[Asia Economy Reporter Lim Jeong-su] OCI, which has experienced steep performance declines over the past three years, is increasingly expected to emerge from the dark tunnel and see the light again. The global expansion of solar investments and the sharp rise in polysilicon prices for solar use have increased the possibility of OCI's performance improvement. OCI currently produces about 30,000 tons of solar polysilicon annually in Malaysia and about 4,400 tons of semiconductor-grade polysilicon annually in Korea.

◆ ‘Polysilicon Supply and Demand Improvement’ to End Deficits

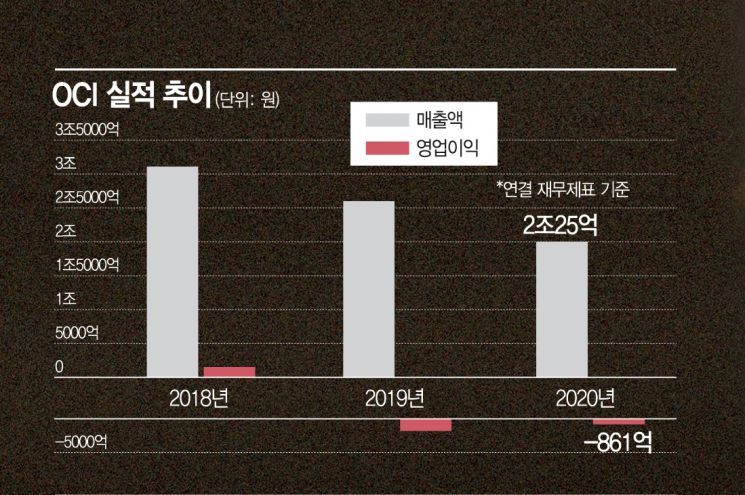

OCI recorded consolidated sales of 2.003 trillion KRW and a loss of 86.1 billion KRW last year. Sales peaked at 3.6 trillion KRW in 2017 but dropped by more than 1.6 trillion KRW within three years. Operating profit also shifted from a 284 billion KRW surplus in 2017 to a 180.6 billion KRW deficit in 2019 and has remained in the red for two consecutive years. Last year, sales significantly decreased due to the suspension of solar polysilicon production at the Gunsan plant, but the overall deficit in the polysilicon segment narrowed.

OCI’s poor performance was a result of falling polysilicon prices. Concerns spread that solar demand would decline due to China’s reduction of solar power subsidies, causing polysilicon prices to plummet from $14/kg in 2018 to $6/kg in the first half of last year. OCI, which generated over 2 trillion KRW in sales and operating profits ranging from 100 billion to 300 billion KRW between 2016 and 2018, had to endure performance deterioration due to the sharp drop in polysilicon prices.

However, the mood reversed this year as polysilicon prices for solar use surged. Prices that had fallen to the low $6/kg range last year rose above $10/kg by the end of last year and have exceeded about $17/kg as of April. A securities analyst explained, "Polysilicon price began to rebound as wafer capacity expansion in the second half of last year led to inventory buildup, reducing new polysilicon expansions," adding, "Recently, the possibility of U.S. sanctions on cells and modules containing polysilicon from China’s Xinjiang Uygur region has caused a sharp price increase."

The increase in solar installation demand this year also raises expectations for performance improvement. According to industry sources, global solar installation demand in 2021 is expected to reach 151 GWh, a 12.7% increase compared to 2020. Meanwhile, the scale of polysilicon expansion in 2021 is likely to be limited to 40,000 tons by Daqo New Energy, a Chinese solar polysilicon company listed in the U.S.

Kang Dong-jin, an analyst at Hyundai Motor Securities, said, "There is a high possibility that solar polysilicon production at the Gunsan plant will resume," adding, "In that case, production could increase by an additional 20% compared to the Malaysian plant volume, leading to performance improvement."

◆ Concerns Over Recurrence of Structural Oversupply... Risks Remain

However, it is uncertain whether the positive atmosphere can continue. Polysilicon prices for solar use are influenced by global supply and demand factors, and large-scale expansions by Chinese companies are scheduled from the second half of this year.

With about 80,000 tons of expansion expected by the end of this year, there are forecasts that polysilicon prices may fall again. According to industry sources, Sichuan Yongxiang in China is currently expanding polysilicon production by 40,000 tons each in September and November, totaling 80,000 tons.

Baek Young-chan, an analyst at KB Securities, predicted, "About 120,000 tons of polysilicon will temporarily flood the market by the end of the year," adding, "Polysilicon prices may decline again from the second half of the year." He explained, "To consume the new supply of 80,000 tons, solar demand needs to exceed 190 GWh, but the likelihood of such demand growth is low," and forecasted, "Structural oversupply of polysilicon will recur from the end of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.