PSK·AmorePacific

S-Oil·Hwasung Enter 등

Considering Demand Increase and Earnings Outlook

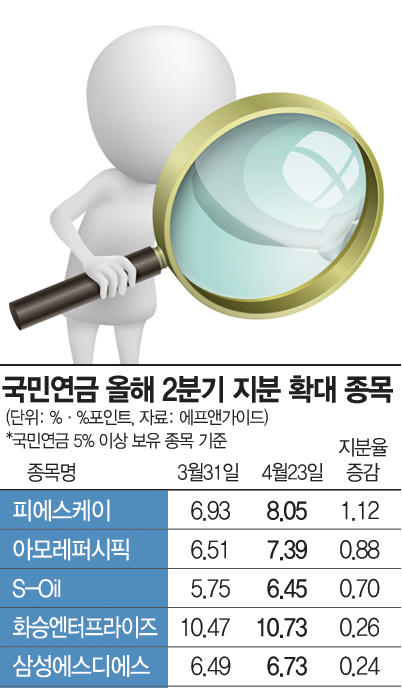

[Asia Economy Reporter Park Jihwan] The stocks that received the most selections from the National Pension Service, a major player in the capital market, in the second quarter of this year were PSK, Amorepacific, and others. Analysts say this reflects favorable earnings forecasts due to recent rapid demand growth.

According to financial information provider FnGuide on the 26th, from the 1st to the 23rd of this month, the National Pension Service increased its stake in a total of five companies in which it holds more than 5% equity. Among them, the largest increases in shareholding were in PSK (6.93%→8.05%), Amorepacific (6.51%→7.39%), S-Oil (5.75%→6.45%), Hwasung Enterprise (10.47%→10.73%), and Samsung SDS (6.49%→6.73%), respectively.

The National Pension Service raised its stake in PSK, a semiconductor front-end equipment company, from 6.93% at the end of March to 8.05% this month, an increase of 1.12 percentage points. PSK has recently attracted attention due to consecutive facility expansion announcements by global semiconductor companies. Global semiconductor suppliers are accelerating capacity expansion as the semiconductor shortage is expected to last more than two years. Intel plans to invest $20 billion (approximately 22.6 trillion KRW) to build two semiconductor factories in Arizona, USA, next month.

Domestic companies such as Samsung Electronics and SK Hynix have also announced plans for facility investments. Kim Kyungmin, a researcher at Hana Financial Investment, said, "Samsung Electronics, the largest customer this year, is expanding its memory semiconductor facility investment compared to last year," adding, "Facility investments in the mature node of the non-memory foundry sector are also positive for earnings." Record-breaking earnings are also anticipated. Han Donghee, a researcher at SK Securities, stated, "The consolidated operating profit for Q1 was 24.3 billion KRW, an increase of more than 40% compared to the previous year, marking the highest-ever performance," and "Annual operating profit is also expected to reach a record high of 61.2 billion KRW, up 94%."

The National Pension Service also increased its stake in Amorepacific, a leading cosmetics company, from 6.51% to 7.39%, a 0.88 percentage point increase. Amorepacific's operating profit peaked at 772.9 billion KRW in 2015 and 848.1 billion KRW in 2016, then declined for four consecutive years. A sharp turnaround is expected this year. The Q1 earnings forecast projects sales of 1.2418 trillion KRW and operating profit of 126.3 billion KRW, up 9.81% and 107.38% year-on-year, respectively. Sales and operating profit are expected to increase by 17.27% and 205.29%, respectively, in Q2. Shin Suyeon, a researcher at Shin Young Securities, said, "High-growth overseas and e-commerce channels, which have relatively high margins, are expanding rapidly, and a large-scale restructuring of traditional channel personnel is underway, resulting in a quarterly labor cost reduction effect of 7.5 billion KRW starting this year."

S-Oil is expected to see a significant increase in inventory-related profits in Q1 due to the rise in average oil prices (Dubai benchmark) by more than $15 per barrel from November-December last year to February-March this year. Although inventory-related profits are expected to decrease in Q2, temporarily reducing refining segment earnings, the petrochemical segment is expected to play a role in profit defense.

Hwasung Enterprise and Samsung SDS are also expected to perform well. Son Hyoju, a researcher at Hanwha Investment & Securities, said, "Hwasung Enterprise's annual operating profit is expected to increase by 53.4% compared to the same period last year," adding, "Growth momentum is expected to revive due to additional facility expansion and increased market share within Adidas." Samsung SDS is expected to post a surprise Q1 operating profit increase of 27% year-on-year, driven by strong sales of its core IT products and business automation solutions.

The stocks that the National Pension Service has focused on buying also show good returns. The average year-to-date return of these five net-purchased stocks is about 17.21%. During the same period, the KOSPI and KOSDAQ indices rose by 10.88% and 6.03%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)