Bank of Korea Overseas Economic Focus

Global Economy Shows Some Differences in Recovery Speed by Country

[Asia Economy Reporter Kim Eun-byeol] Recently, international oil prices, which have shown a sharp rise, are expected to continue fluctuating sensitively in response to various global issues for the time being.

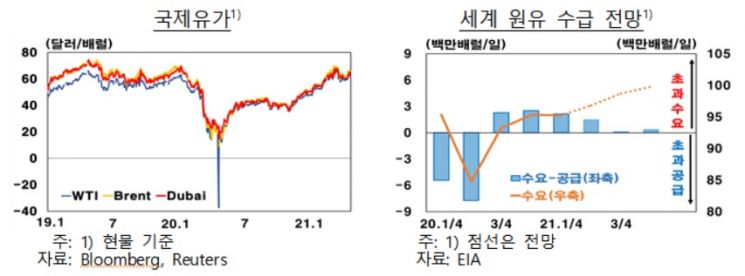

On the 25th, the Bank of Korea stated in its 'Overseas Economic Focus' report, "Future international oil prices are expected to fluctuate sensitively in response to factors such as the expansion of crude oil demand due to global economic recovery, increased U.S. shale oil production, and the resumption of Iranian crude oil exports."

In April, international oil prices (based on Dubai crude) temporarily entered the $50 per barrel range but recently rose to the low $60 range. As of the 21st, the Dubai crude price was $63.3 per barrel, and Brent crude was $64 per barrel. In early April, prices fell due to the gradual adjustment of production cuts announced by OPEC+ and Saudi Arabia, along with the resurgence of COVID-19 in regions such as Europe. However, in mid-April, oil prices turned upward influenced by factors such as the expansion of U.S. crude oil inventory declines and expectations of oil demand recovery due to vaccine distribution.

Other commodity prices are also rising. The LMEX non-ferrous metals index averaged a 1.7% increase from April 1 to 21 compared to the previous month, and the S&P grain index rose 2.0% month-on-month.

The global economy is showing somewhat different speeds and strengths of recovery by country. The U.S. economy faltered somewhat in February due to a cold wave but has been recovering rapidly since March, driven by a large-scale economic stimulus package including $1,400 cash payments per person, reopening of economic activities, and smooth vaccine distribution. Considering the active fiscal spending stance and improvements in the COVID-19 situation, the Bank of Korea expects the recovery to strengthen further going forward.

The Eurozone economy’s improvement is delayed due to extended lockdown measures in major countries. Industrial production turned downward in February, exports continued to decline, and although retail sales rebounded, they remain at low levels. Due to the spread of variant viruses and low vaccination rates, sluggishness is expected to continue for the time being.

Japan’s economic improvement is somewhat constrained, while China’s economy is showing solid growth supported by strong exports and domestic demand recovery. Emerging economies are experiencing slow recovery as domestic demand remains weak and new COVID-19 cases surge sharply.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)