Popular as Sale Apartments from Metropolitan Area to Provinces

Triple-Digit Competition Rates at Shinasan Moaelga Vista Phase 2 and Others

No Separate Standard for Sale Price Calculation... High Sale Prices Possible

Some Complexes Lack Priority Rights for Residents in Sale Conversion

[Asia Economy Reporter Ryu Tae-min] As apartment sale and jeonse prices soar to unprecedented levels, demand is flooding into private rental apartments. Competition rates in the triple digits, comparable to those for general sale apartments, are becoming common. This is because the advantages of relatively affordable prices, stable residence for a certain period, and the option to convert to ownership have been highlighted. However, experts caution that unlike public rental apartments, private rentals lack separate standards for calculating sale prices, and many complexes have uncertain sale conversion prospects, so caution is advised.

Private Rentals as Popular as General Sales

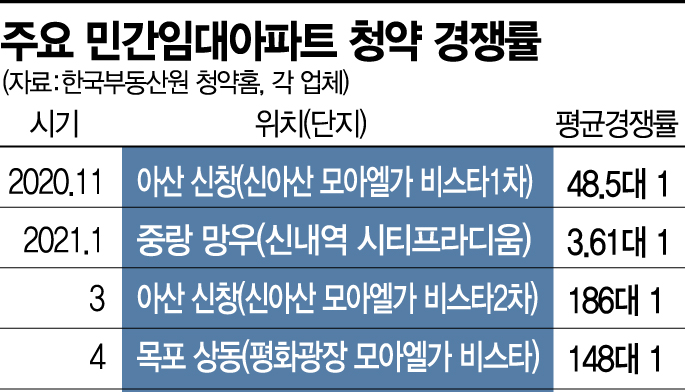

According to the real estate industry on the 24th, the ‘Shin Asan Moa Elga Vista 2nd Phase’ in Asan-si, Chungnam, which held a subscription last month, attracted 186,358 applications for 998 units, recording an average competition rate of 186 to 1. For the 84㎡ (exclusive area) units, 368 units received 143,092 applications, reaching a competition rate of 388 to 1. Compared to the first phase supply of this apartment in November last year (average 48.5 to 1), this is nearly four times higher.

The situation was similar for the ‘Pyeonghwa Square Moa Elga Vista’ in Mokpo-si, Jeonnam, which conducted online subscriptions from the 9th to the 12th. With 217 units supplied and 32,118 applications, the competition rate was 148 to 1. Additionally, the ‘Sinnae Station City Pradium’ supplied earlier this year in Mangwoo-dong, Jungnang-gu, Seoul, also closed subscriptions early with 3,408 applicants for 943 units.

Private rental apartments are those where residents live on rent for a certain period before deciding whether to convert to ownership. Anyone can apply regardless of whether they hold a subscription savings account, income restrictions, or home ownership. Another advantage is that as rental apartments, residents do not pay acquisition tax or property tax. Consequently, some private rental housing rights recently supplied have been traded at premiums ranging from several million to tens of millions of Korean won immediately after sale. This is due to expectations of profit if the sale price at conversion is lower than the market price, attracting both actual demand and investment demand.

Uncertain Sale Conversion and Pricing... ‘Potential Risks’

However, experts point out that unlike public rentals, private rentals carry risks regarding sale prices at conversion. Current law does not specify regulations for calculating sale prices at conversion. This means developers can autonomously set sale prices.

Choi Eun-young, director of the Korea Urban Research Institute, explained, “Unlike public rental apartments, private rentals lack regulations related to sale prices, so construction companies can set prices as high as they want. Especially in times of rapid house price increases like now, conflicts related to this can intensify.” In fact, the contract for ‘Pyeonghwa Square Moa Elga Vista,’ which completed online subscriptions on the 12th, states that “the sale price at conversion will be decided by the lessor.”

There is also a possibility that sale conversion may not occur after the rental period expires. The contract for ‘Sinnae Station City Pradium,’ which completed subscriptions in January, states that “no priority for sale conversion will be granted to tenants after the mandatory rental period ends.” The contract for ‘Shin Asan Moa Elga Vista 2nd Phase’ also includes a clause that “sale conversion is not confirmed.”

Yeokyung Hee, senior researcher at Real Estate 114, advised, “Since the standards for sale price calculation and sale conversion vary by complex in private rental apartments, caution is necessary. It is important to carefully review the contract before deciding whether to sign.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)