Korea Financial Investment Association Signs Contract with Samjong KPMG for Cost Analysis of Merchant Fee Rates

Political Circles "Lower Fees for Small Businesses" vs Card Industry "No Room for Further Increases"

[Asia Economy Reporter Ki Ha-young] Discussions for the triennial reassessment of card merchant fee rates are set to intensify. While the card industry maintains that there is no room left for further reductions, voices are growing louder in the political sphere ahead of next year's presidential election, calling for additional fee cuts to support self-employed individuals and small business owners struggling due to the COVID-19 pandemic.

According to industry sources on the 24th, the Korea Credit Finance Association has selected Samjong KPMG as the consulting firm to conduct the cost analysis for card merchant fee rates and signed a service contract yesterday. Once the accounting firm for calculating eligible costs is chosen, a task force (TF) comprising the Financial Services Commission, the Korea Credit Finance Association, and card companies will be formed to reassess the fee rates.

The reassessment of merchant card fee rates has been conducted every three years since the revision of the Specialized Credit Finance Business Act in 2012. Fee rates are determined by reviewing eligible costs calculated based on cost analyses including card companies' funding costs, risk management costs, general administrative expenses, VAN fees, and marketing expenses. The newly calculated eligible costs form the basis for determining the capacity for fee reduction, and the revised card merchant fee rates will be applied starting next year.

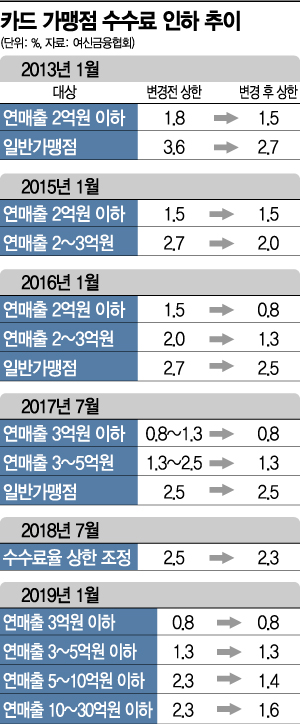

Merchant Fee Rates Reduced 13 Times Over 12 Years

Card merchant fee rates have been reduced 13 times over 12 years from 2007 to 2019. As a result, the general merchant card fee rate, which was as high as 4.5% in 2007, has nearly halved to between 1.97% and 2.04%. Notably, in 2018, the scope of preferential merchants was expanded from those with annual sales under 500 million KRW to those under 3 billion KRW, resulting in 96% of all merchants benefiting from preferential fee rates ranging from 0.8% to 1.6%. The card industry explains that, considering tax benefits, merchants with annual sales under 1 billion KRW effectively face fee rates in the 0% range. In fact, credit card sales generated by merchants with annual sales under 1 billion KRW receive tax credits up to 10 million KRW annually within a 1.3% limit, making the fee burden almost negligible.

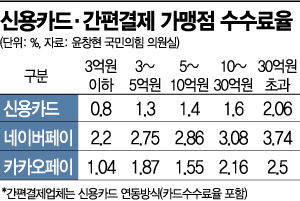

Providing the Same Service... Big Tech Fee Rates Up to 1.68%p Higher

The issue of an 'uneven playing field' with big tech companies (large information and communication enterprises) has also been raised. The upper limit for credit card merchant fee rates ranges from 0.8% to 2.3%, with preferential rates applied to merchants with sales under 3 billion KRW. However, simple payment service providers like Naver Pay and Kakao Pay, which also charge merchant fees, are not subject to regulations on merchant fee rates. According to the office of Yoon Chang-hyun, a member of the People Power Party, Naver Pay's fee rates range from 2.2% to 3.74%, and Kakao Pay's from 1.04% to 2.5%, which are between 0.15 and 1.68 percentage points higher than those of the card industry. Even if the simple payment providers' fees include credit card fees and various additional services, there are concerns about fairness since they provide the same services. For non-credit card debit payments, Naver Pay charges 1.65% of the payment amount, Kakao Pay charges between 1.02% and 2.28%, whereas check card fee rates range from 0.5% to 1.5%.

Fee Rate Cuts Ultimately Lead to Reduced Customer Benefits

There are also concerns that reductions in merchant fee rates will inevitably lead to diminished benefits for card customers. An industry insider said, "Merchant fees, along with annual fees, are the fundamental resources for providing benefits to card customers. If merchant fees result in negative margins, it is inevitable that customer benefits, starting with new product perks, will be reduced." In fact, many so-called premium cards have been discontinued in recent years. In 2019, 160 types of credit cards were discontinued, and last year, the number reached 157.

Will Rates Drop Again This Year? Card Companies Worry Despite Last Year's Strong Performance

The card industry is already concerned about the possibility of further reductions in merchant fee rates, which are currently at cost level. Last year's low-interest-rate environment lowered funding costs and reduced sales and marketing expenses, which could ironically justify additional fee cuts.

In the political arena, calls for further fee reductions are growing to support self-employed individuals and small business owners struggling due to the prolonged COVID-19 pandemic. Last month, independent lawmaker Lee Yong-ho proposed an amendment to the Specialized Credit Finance Business Act to apply additional preferential card fee rates exclusively for small-scale merchants. People Power Party lawmaker Koo Ja-geun also proposed an amendment to the same act to fully exempt card fees on small card payments under 10,000 KRW for small and medium-sized credit card merchants with annual sales under 3 billion KRW, and to apply preferential fee rates to merchants in traditional markets regardless of sales size.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)