March Loans by 5 Major Banks Down 4 Trillion Won from March Last Year

Corporate Bond Issuance of 11.3 Trillion Won in Jan-Feb

Approaching Last Year's Q1 Level in Two Months

[Asia Economy Reporter Kim Hyo-jin] The focus of large corporations' financing is shifting back from bank loans to corporate bond issuance. This is attributed to the gradual recovery of the corporate bond market, which had frozen due to the impact of COVID-19, and the increased expectations for economic recovery.

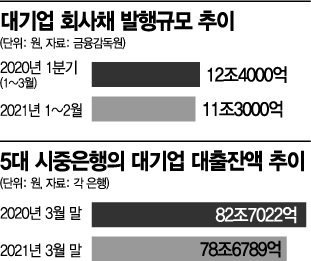

According to the financial sector on the 23rd, as of the end of March this year, the outstanding loans to large corporations from the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?were 78.6789 trillion won. This is about 4.0233 trillion won (4.9%) less compared to 82.7022 trillion won at the end of March last year.

There was a slight increase through January (79.9362 trillion won) and February (80.4409 trillion won) due to equipment investment demand at the beginning of the year, but a noticeable decrease occurred in March.

Conversely, the scale of corporate bond issuance by large corporations has increased significantly this year. According to the Financial Supervisory Service's data, the amount of corporate bonds issued by large corporations in January and February reached 11.3 trillion won, approaching the level of 12.4 trillion won in the first quarter of last year.

Large corporations typically raise funds through direct financing such as corporate bonds. However, last year, the COVID-19 pandemic severely impacted both the real economy and finance, causing the bond market to suddenly freeze and credit crunch to intensify, resulting in a very high dependence on bank loans.

A financial sector official explained, "Due to the effect of low interest rates, corporate demand for bond issuance increased, and as institutional investors resumed fund execution, issuance expanded mainly in high-quality general corporate bonds."

This explanation is supported by the fact that, as of the 16th of this month, the increase in corporate bond issuance balance by the top 10 groups?Samsung, Hyundai Motor, SK, LG, Lotte, Hanwha, GS, Hyundai Heavy Industries, Shinsegae, and CJ?reached 8.58 trillion won, far exceeding last year's annual net increase of 5.1445 trillion won.

A financial sector official predicted, "Although various factors such as COVID-19 vaccine supply, spread trends, and quarantine policies may have an impact, the dependence on bank loans is unlikely to increase significantly as it did last year."

SMEs Still Rely on Loans to Endure

Unlike large corporations, the loan dependence of small and medium-sized enterprises (SMEs) remains high. According to the Bank of Korea, as of the end of last month, the outstanding bank loans to SMEs increased by 7.3 trillion won from the previous month to 826.9 trillion won.

This contrasts with the outstanding loans to large corporations, which decreased by 2.7 trillion won to 173.1 trillion won during the same period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.