LG Household & Health Care Records Highest Quarterly Earnings

Operating Profit 370.6 Billion KRW, Up 11%

Amore's Operating Profit Expected to Surge 148%

Focus on 15 Hainan Duty-Free Stores

[Asia Economy Reporter Seungjin Lee] LG Household & Health Care achieved its highest quarterly performance ever in the first quarter of this year, continuing its growth streak for 64 consecutive quarters. The revival of the Chinese cosmetics market led to improved performance in the cosmetics division, driving overall sales. Amorepacific, which saw a sharp decline in sales and operating profit last year due to the impact of COVID-19, also reported significant improvement in first-quarter results thanks to the strong Chinese market, raising expectations for a resurgence in the beauty industry.

LG Household & Health Care Significantly Improves Cosmetics Performance

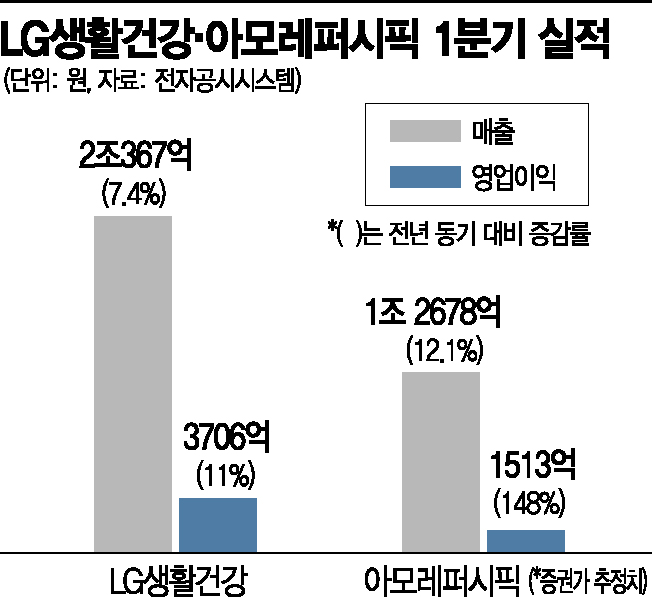

According to the cosmetics industry on the 23rd, LG Household & Health Care recorded sales of KRW 2.0367 trillion, operating profit of KRW 370.6 billion, and net profit of KRW 258.8 billion in the first quarter of 2021. These figures represent increases of 7.4%, 11%, and 10.5%, respectively, compared to the same period last year. Despite the challenging business environment in domestic and overseas markets due to COVID-19, all three business sectors?Beauty, HDB (Household & Daily Care), and Refreshment (Beverages)?achieved growth in sales and profits, resulting in the highest first-quarter performance ever. Sales have grown for 61 consecutive quarters since the third quarter of 2005, and operating profit has grown for 64 consecutive quarters since the first quarter of 2005.

Among the three major growth pillars?beauty, household goods, and beverages?the cosmetics segment, which holds the largest share, showed significant improvement. The beauty business posted first-quarter sales of KRW 1.1585 trillion, up 8.6% year-on-year, and operating profit of KRW 254.2 billion, up 14.8%.

Hoo grew by 31% compared to the same period last year, while the high-end lines Rosyce Summa and The First from the brands Soom and O Hui grew by 40% and 64%, respectively. LG Household & Health Care plans to strengthen its product lineup targeting the local MZ generation (Millennials + Gen Z) in China this year, led by the highly recognized brand ‘The Face Shop’.

The household goods business continued its growth trend, supported by an increased share of premium brands, and sales of the laundry detergent brand ‘Pigeon’ grew by 65% amid rising concerns about virus contact. The beverage business saw sales increase year-on-year due to growth in overseas brands such as ‘Coca-Cola’ and ‘Monster Energy’.

Amorepacific’s Operating Profit Expected to Surge 148%

Amorepacific, which is scheduled to announce its earnings on the 28th, is also expected to report strong first-quarter results. Securities firms forecast Amorepacific’s first-quarter sales and operating profit to increase by 12.1% and 148.0%, respectively, year-on-year, reaching KRW 1.2678 trillion and KRW 151.3 billion. The shift of major marketing channels to e-commerce and the revival of the Chinese market have greatly improved performance.

Recently, China’s leading state-run media published an advertisement promoting Korean tourism followed by an interview article with a Korea Tourism Organization official, raising expectations for the easing of the ‘Hanhanryeong’ (Korean Wave restriction). This has led to a steady increase in domestic cosmetics sales in the Chinese cosmetics market.

According to the duty-free industry, in January, sales by Chinese ‘bootae’ (informal traders) at domestic duty-free shops surged by more than 30%, mainly consisting of major cosmetics brand products.

Amorepacific is focusing on the Hainan duty-free market in China, one of the key growth drivers of the duty-free sector, aligning with the atmosphere of Hanhanryeong lifting. Currently, it operates more than 15 stores across four Hainan duty-free locations, centered on the Sulwhasoo and Laneige brands, and is actively responding to the Chinese duty-free market through a business agreement with China’s largest duty-free distributor CDFG.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.