[Asia Economy Reporter Kim Eun-byeol] Thanks to the increase in exports and the enthusiasm for stock investment in the first quarter (January to March), the average daily foreign exchange transaction volume rose to the highest level since 2008.

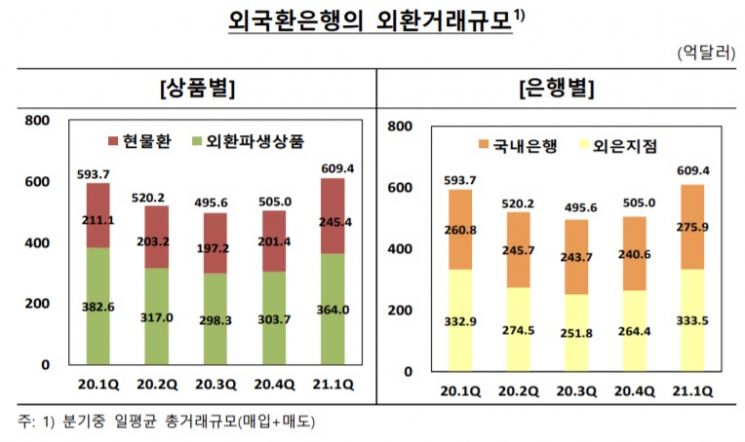

According to the "Foreign Exchange Bank Foreign Exchange Transaction Trends" announced by the Bank of Korea on the 23rd, the average daily foreign exchange transactions (spot exchange and foreign exchange derivatives transactions) of foreign exchange banks in the first quarter amounted to $60.94 billion.

This is an increase of 20.7% ($10.44 billion) compared to the previous quarter of last year (Q4, $50.5 billion), marking the highest record since the statistics revision in 2008.

As the scale of exports and imports increased from $265.58 billion in Q4 last year to $282.59 billion in Q1 this year, the foreign exchange transaction volume also rose. In particular, the settlement amount of foreign currency securities by domestic investors surged by 75%, from $89.88 billion to $157.56 billion.

A Bank of Korea official explained, "Foreign exchange transactions increased due to the expansion of export and import scale in the first quarter and the increase in securities investment by residents and foreigners."

By product, spot exchange transactions ($24.54 billion) increased by 21.8% ($4.4 billion) compared to the previous quarter, and foreign exchange derivatives transactions ($36.4 billion) rose by 19.9% ($6.04 billion).

By bank, among foreign exchange banks, domestic banks' foreign exchange transaction volume ($27.59 billion) increased by 14.7% ($3.53 billion), and foreign bank branches' foreign exchange transaction volume ($33.35 billion) rose by 26.1% ($6.91 billion).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.