Seoul City 38 Tax Collection Division Identifies 1,566 High-Value Delinquents Holding Cryptocurrency in 3 Major Exchanges

676 Individuals' Cryptocurrency Worth 25.1 Billion KRW Immediately Seized... 118 Pay Taxes Voluntarily After Notification

Swift Seizure and Ongoing Investigation Planned for Remaining 890 High-Value Delinquents

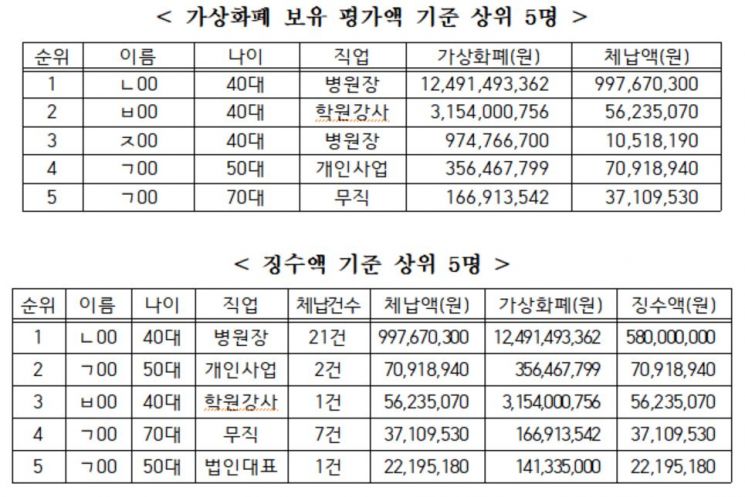

[Asia Economy Reporter Lim Cheol-young] Director A of a hospital in Seoul owed 997.67 million KRW in unpaid taxes but held virtual currencies valued at 12.49149 billion KRW (appraised value). When the Seoul City 38th Tax Collection Division confirmed the existence of these virtual currencies and seized them, he immediately paid 580 million KRW, about half of the unpaid amount, provided collateral for the remaining debt, and requested a suspension of the virtual currency sale. Instructor B also held virtual currencies worth 3.154 billion KRW (appraised value) but owed 56.23 million KRW in taxes. Upon seizure of the confirmed virtual currencies by the 38th Tax Collection Division, he paid the entire outstanding tax amount.

Seoul City identified 1,566 high-value tax delinquents holding virtual currencies and promptly seized the virtual currencies of 676 of them to recover taxes. These individuals had concealed assets in virtual currencies worth 28.4 billion KRW to evade tax payments despite owing taxes. Seoul City plans to take seizure actions against the remaining 890 individuals and continue investigations.

On the 23rd, the Seoul City 38th Tax Collection Division announced that it identified 1,566 high-value tax delinquents holding virtual currencies such as Bitcoin and Ethereum through the three major virtual currency exchanges and seized all virtual currencies worth 25.1 billion KRW in 860 accounts held by 676 individuals who could be immediately seized. This was the result of focused tracking by the 38th Tax Collection Division’s “Economic and Financial Tracking Task Force (TF),” established in January to collect taxes from high-value delinquents.

This is the first time virtual currencies concealed by high-value tax delinquents have been identified and seized. On March 26, Seoul City requested virtual currency holding data of high-value delinquents from four major virtual currency exchanges and obtained data from three of them. Seoul City notified the delinquents of the seizure and plans to encourage payment of the outstanding taxes first, with immediate release of the seizure if the full tax amount is paid.

Lee Byung-han, Director of the Finance Bureau, explained, “We obtained information that some high-value tax delinquents are abusing virtual currencies as a means to conceal assets by exploiting the intangible nature of virtual currencies while making large profits due to recent price surges. We quickly secured data through virtual currency exchanges and carried out seizure actions.”

The seizure effect is immediate. After the seizure blocked virtual currency transactions, 118 out of the 676 individuals voluntarily paid 1.26 billion KRW in unpaid taxes. A representative of the Seoul City 38th Tax Collection Division said, “We are receiving requests from delinquents asking to suspend the sale of virtual currencies in exchange for paying taxes,” adding, “Due to the recent surge in virtual currency prices, they expect the value to rise further and judge that paying the tax to lift the seizure is more profitable.”

Seoul City plans to sell the seized virtual currencies at current market prices if the delinquents do not pay taxes after encouragement. If the sale proceeds are less than the unpaid taxes, additional assets will be found and seized; if more, the surplus will be returned to the delinquent.

Additionally, Seoul City will promptly seize virtual currencies of the remaining 890 individuals and continue investigations such as designating secondary taxpayers and tracing fund sources. The remaining 890 include cases where the virtual currency data did not exactly match, only small amounts of Korean won without virtual currencies were held, or the individuals were representatives of delinquent corporations.

Seoul City is focusing on this area through the “Economic and Financial Tracking TF” as cases of high-value delinquents cleverly concealing assets using undisclosed methods such as virtual currencies or artworks have increased recently. They plan to extend tracking to new fields such as artworks. In particular, legal action will be taken against one exchange that has delayed submitting data despite legitimate requests under local tax laws. Rumors have spread among delinquents who received seizure notices that Seoul City is seizing their virtual currencies, leading to the possibility that delinquents using that exchange might sell virtual currencies and withdraw proceeds.

A representative of the 38th Tax Collection Division said, “Since it is important that the seizure of delinquent virtual currencies is carried out swiftly and simultaneously, we plan to take appropriate measures under local tax laws, including direct searches of the exchange and imposing fines for violation of orders.” Seoul City has also requested virtual currency holding data of high-value delinquents from 14 of the top 30 domestic virtual currency exchanges (based on data from the Korea Corporate Reputation Research Institute).

Director Lee said, “Despite the prolonged economic difficulties caused by COVID-19, we will carry out thorough collection activities against unscrupulous high-value delinquents so that honest citizens who pay taxes faithfully do not feel relatively deprived,” and added, “We will pursue collection to the end to realize tax justice.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)