National Assembly Political Affairs Committee Presents Bank Act Amendment

Allows Principal Loan Reduction...Unique Worldwide

Industry: "Law Forces Financial Firms to Bear Self-Employed Losses"

Experts: "Concerns Over Moral Hazard, Low-Credit Borrowers May Face Loan Restrictions"

Yoon Kwan-seok, Chairman of the National Assembly's Political Affairs Committee, is presiding over the full meeting of the Political Affairs Committee on the 22nd. Photo by Yoon Dong-ju doso7@

Yoon Kwan-seok, Chairman of the National Assembly's Political Affairs Committee, is presiding over the full meeting of the Political Affairs Committee on the 22nd. Photo by Yoon Dong-ju doso7@

[Asia Economy Reporters Kwangho Lee, Kiho Sung, Seungseop Song] A globally unprecedented bill is being pushed that would effectively obligate financial institutions to forgive debts when the income of self-employed individuals and office workers decreases due to disasters. Although the government, financial sector, and National Assembly expert committee members who provide legislative review guidelines oppose the bill, the ruling party is pushing it through with a majority in the National Assembly. This move is aimed at winning public favor after the crushing defeat in the April 7 by-elections, but there are concerns that such populist demands could backfire in the next presidential election.

On the 22nd, the National Assembly's Political Affairs Committee held a plenary session and presented the "Partial Amendment to the Bank Act" and the "Partial Amendment to the Financial Consumer Protection Act," both proposed by Min Hyung-bae, a member of the Democratic Party of Korea who previously served as the Social Policy Secretary at the Blue House under the current administration.

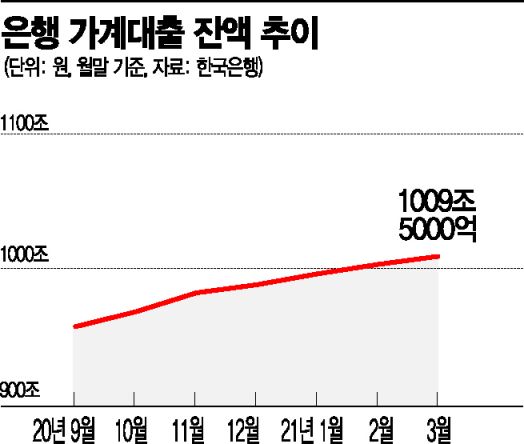

The amendments allow business operators who have received orders to restrict operations or close business premises, or whose income has significantly decreased due to rapid economic changes, to apply to banks for principal debt reduction or deferment of principal and interest repayments. Banks are required to take related measures considering the applicant's income reduction scale. This creates a mandatory regulation that if self-employed income sharply declines during a crisis, they can request debt forgiveness from banks, which must take appropriate action. The Financial Services Commission will have the authority to order loan reductions or defer insurance premium payments.

The lawmakers who proposed the amendments cited the need to "prevent an increase in unemployed persons due to business owner bankruptcies and the widening wealth gap" as reasons. However, there is strong criticism that forcing private listed financial companies to share losses instead of responding with government finances during disasters disrupts market order. Concerns have also been raised about moral hazard, where more people might demand principal reductions even with slight economic downturns, and that it could raise the borrowing threshold for vulnerable groups.

There are no cases anywhere overseas where loan principal has been forgiven. The U.S., Spain, and Italy have legislated for deferral of principal and interest repayments, mostly through social consensus bodies.

Government and Financial Sector Oppose: "The Credit Society Itself Could Be Shaken"

This bill has drawn opposition from the government, financial sector, and National Assembly expert committee. Eun Sung-soo, Chairman of the Financial Services Commission, responded to a query from Democratic Party lawmaker Min Hyung-bae, who proposed the bill in February, stating, "If banks are fined for not complying with debt adjustment requests, the system and the credit society itself could be shaken," emphasizing, "Such matters should be handled by government finances, not financial companies."

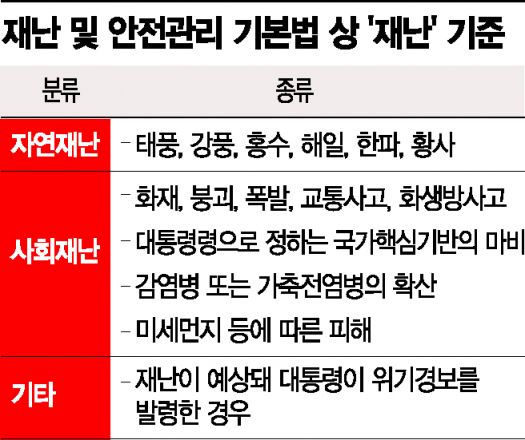

The scope of applicable disasters is also ambiguous. The proposed bill covers all conceivable disasters, including natural disasters such as typhoons, floods, and heavy rains; social disasters such as fires, collapses, and explosions; and any disasters for which the president can issue a crisis alert above the warning level. It also includes current social issues such as infectious diseases, livestock epidemics, fine dust, and environmental pollution incidents if they exceed a certain scale. For example, if fine dust worsens and is judged to cause significant damage, borrowers could demand principal forgiveness from banks.

The financial sector argues that this is shifting losses from social disasters onto financial companies. Although finance is a regulated industry, it is still a private enterprise, and there is strong dissatisfaction with excessive political interference. A financial sector official said, "Disasters should be addressed with government finances, so I don't understand why private listed financial companies should share losses," adding, "Ultimately, this could lead to interest rate increases, passing the burden onto other consumers who are faithfully repaying their loans." Another official lamented, "This means banks have to bear the losses of self-employed individuals. It feels less like a profit-sharing system and more like a profit confiscation system."

Experts also express concerns that the bill reverses the current financial system and disrupts market order. Professor Sangbong Kim of Hansung University’s Department of Economics criticized, "This bill would collapse the financial system itself," explaining, "Loans are based on credit rating agencies' evaluations, which determine limits and interest rates. If principal is reduced, the system itself becomes useless." Professor Seongin Jeon of Hongik University’s Department of Economics said, "Principal forgiveness and repayment adjustments should, in principle, be handled by the courts," adding, "If urgent, government finances should be used to resolve the issue."

Concerns have also been raised about moral hazard, where people might demand principal reductions or take loans without intending to repay if situations become slightly difficult. Professor Jiyong Seo of Sangmyung University’s Business Administration Department said, "There could be issues of infringement on banks' property rights and shareholder backlash," warning, "If loans become non-performing, banks could also face risks."

There is also a viewpoint that low-credit borrowers could face even more difficulties if the bill is applied. Professor Kim warned, "Although the law is made with good intentions, if it passes, banks will only lend to borrowers who can repay, making it harder for low-credit borrowers to get loans."

Populism Triggered by By-Elections: Will It Continue Until Next Year’s Presidential Election?

The financial sector fears that considering the political timetable leading up to next year’s presidential election, such populism will peak. Experts warn that if politics continues to disrupt market logic, the foundation of the market economy order will collapse, and the damage will be passed on to vulnerable groups.

According to political and financial circles, the Political Affairs Committee has also presented the "Partial Amendment to the Act on Registration of Credit Business and Protection of Financial Consumers," which includes provisions for lending institutions to reduce landlords' loan interest rates with the state providing secondary compensation. The "Partial Amendment to the Small Business Basic Act," which aims to reduce rent and loan interest in addition to business compensation, is also on the agenda.

Ruling party-driven pain-sharing demands on the banking sector are nothing new. Last month, the amendment to the Support for Low-Income Financial Consumers Act, which collects about 100 billion won annually from banks to fund low-income financial products and is regarded as a "financial sector profit-sharing system," was passed. The principal and interest repayment deferral measures for small and medium enterprises and small business owners, which were scheduled to end last month, were also extended. Former Democratic Party leader Lee Nak-yeon summoned financial company CEOs to demand easing of loan-deposit interest rates, and Policy Committee Chairman Hong Ik-pyo argued, "Not only should rent be reduced, but bank interest rates should also be stopped or limited."

Experts point out that financial policies are being distorted as they are used to suit political tastes. Professor Kim criticized, "Although government-controlled finance is pointed out as a problem, the current situation goes beyond that, with politics controlling finance," adding, "Excessive populism is problematic, but the bigger issue is that politicians do not understand the financial system itself." Professor Jeon of Hongik University’s Department of Economics said, "The political sphere must abandon the desire to use finance as a political tool."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.