Opposition: "'Let's put out the urgent fire first' is a face-saving rushed law amendment" criticized... Prime Minister nominee Kim Bu-gyeom: "Principles must not be broken"

[Sejong=Asia Economy Reporter Son Seon-hee] The ruling Democratic Party and the government are expected to accelerate efforts to ease the property tax for single-home owners. The ruling party aims to push for the 'single-home property tax relief' during the May extraordinary session of the National Assembly, and the government has also decided to proceed with discussions swiftly.

If the law is amended before the comprehensive real estate tax assessment date (June 1), the number of taxpayers subject to the tax this November is likely to decrease. Separately, there are criticisms that the ruling party, which had been firmly opposed to changes in real estate taxation until just a month ago, is now hastily trying to appease public sentiment, leading to accusations of a rushed process.

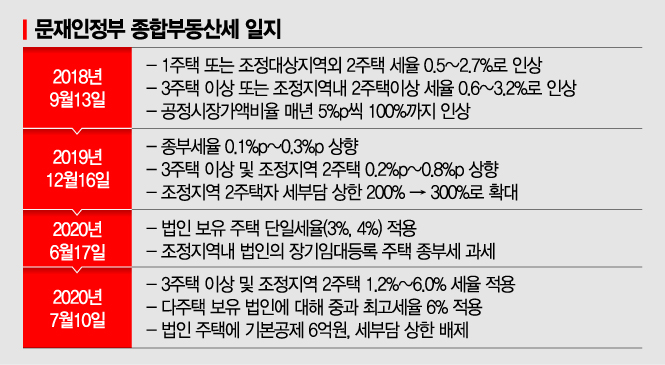

According to the Democratic Party and the government on the 22nd, they are expected to discuss an amendment to the Comprehensive Real Estate Tax Act through an upcoming party-government consultation to ease the current tax threshold for single-home owners from "officially assessed value exceeding 900 million won" to 1.2 billion won. With the Democratic Party leading and the government supporting, the speed of the legislative amendment is expected to accelerate. The Ministry of Economy and Finance responded officially to the statement made the previous day by Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki, who said, "We will proceed with the consultation process between the party and government as quickly as possible to promptly remove market uncertainties." Given the expected replacement of economic ministers next month, it is interpreted that Acting Minister Hong intends to resolve this issue within his term.

The Democratic Party also plans to hold the first meeting of the Special Committee on Real Estate on the 23rd to gather opinions within the party and finalize the party's stance on easing the comprehensive real estate tax. Recently, several party members have proposed bills to ease the tax, and if the law is amended before the assessment date, it is expected to be reflected in the tax notices issued this November.

However, the shock caused by sudden policy changes is a concern. The government and ruling party have so far strictly drawn a line against easing 'holding tax and capital gains tax' to stabilize the housing market, but the recent change came after an election defeat. This gives sufficient grounds for the perception that the tax system is being altered based on political logic. If the amendment to the Comprehensive Real Estate Tax Act passes in the National Assembly next month, the strengthened tax measures prepared through last year's tax law amendment will never be implemented and will be discarded without use, resulting in a farce.

Therefore, there are considerable opinions that the process should be pursued cautiously. On the same day, Park Soo-young, a member of the People Power Party, stated in a press release, "It is welcome to reflect on the government's policy failures and listen to the people's wishes regarding the comprehensive real estate tax reform," but added, "I oppose a face-saving legislative amendment that just aims to 'put out the urgent fire'." Prime Minister nominee Kim Boo-kyum, when asked about changes in real estate policy on the morning of the same day, said, "Principles should not be broken," and added, "If questions arise during the confirmation hearing, I will clarify the government's intentions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.