[Asia Economy Reporter Ji-hwan Park] Samjong KPMG forecasted in a report published on the 21st (Insurance Industry, Acceleration of Separation of Manufacturing and Sales and the Era of Consumer-Oriented Recruitment Channel Competitiveness) that a new competitive landscape is expected due to the expanding influence of big tech and fintech within the insurance industry. It analyzed that the establishment of order in insurance market recruitment and consumer protection issues, along with the strengthening trend of separation of manufacturing and sales, will impact insurers' sales channel strategies.

As the insurance industry matures, a global phenomenon of 'separation of manufacturing and sales' is emerging, where insurance product planning and development, insurance underwriting, and assessment are handled by insurers, while sales and distribution are managed by separate organizations such as exclusive channels and GA (General Agencies, corporate insurance agencies), through fragmentation and bundling within the value chain.

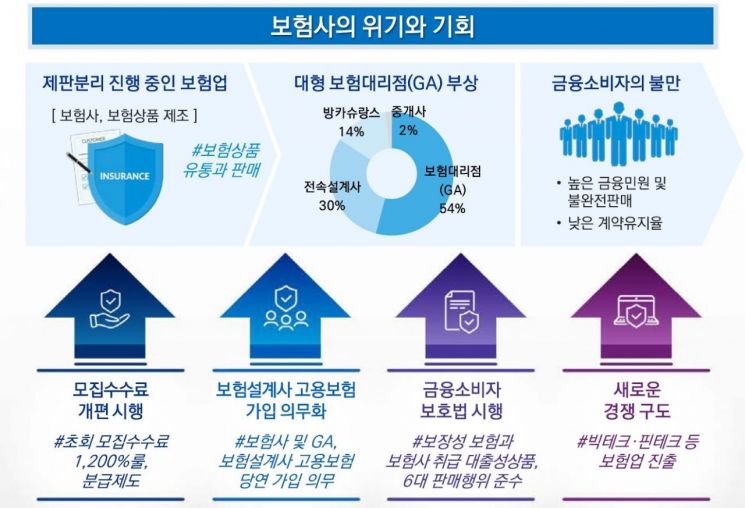

According to the report, domestic insurance (both non-life and life insurance) has seen a significant slowdown in growth since 2015, and the separation of manufacturing and sales in insurance sales channels, centered on large GAs, has intensified. Between 2015 and 2019, insurance premium income in the insurance industry decreased by 0.4%, whereas premium income through insurance agency channels increased by 22.2% during the same period, with 54.2% (43.1 trillion KRW) of premium income in 2019 being sold through insurance agencies.

The government restructured the recruitment commission system and implemented the Financial Consumer Protection Act to protect financial consumers and establish a sound sales culture in the insurance industry. Since January this year, for protection-type insurance, the first-year recruitment commission (including incentives) paid to insurance recruiters is limited to within the total annual premium (less than 1,200% of the monthly premium), with the introduction of installment payment methods and clearer standards for commission payments.

Under the Financial Consumer Protection Act, insurance products including variable insurance are classified as protection products, and loan-type products handled by insurers are also subject to regulation. Insurers and banks are considered direct sellers, while non-exclusive channels such as insurance planners, insurance brokers, and GAs are classified as sales agents or intermediaries and are regulated accordingly. All protection and loan-type products must comply with six major sales principles, including suitability, appropriateness, and explanation obligations. Insurers or GAs employing insurance recruiters are required to enroll in employment insurance mandatorily from July 2021.

The report states that the revised recruitment commission system currently applied to face-to-face channels will be extended to non-face-to-face channels starting in 2022. It is expected to affect not only the insurance sales income of individual insurance recruiters but also the incentives for recruiters to move between insurers and GAs, the cost structure of GAs, and the business models and competitive landscape between insurers and GAs. Management deterioration is anticipated mainly among GAs with low capital strength, and while the Financial Consumer Protection Act may suppress insurance recruiters' sales activities, it is important for insurers to secure sound sales channels.

The report explained, "Fintech and big tech companies, which have been actively advancing in the financial industry recently, are also entering the insurance product sales and manufacturing sectors in earnest," adding, "Major big tech companies are establishing GA subsidiaries or preparing for insurance business licenses, indicating a high possibility of expanding their influence within the insurance industry through platforms, customers, and technology." It emphasized, "In the changing insurance industry environment, insurers need an approach to strengthen consumer-oriented sales channels above all to secure competitive sales channels and sustain growth."

Key strategies for strengthening consumer-oriented sales channels include securing the intrinsic competitiveness of insurance products and services, preparing plans to nurture professional insurance recruiters, diversifying and enhancing competitiveness of recruitment channels through multi-channel strategies, and exploring sales channel expansion strategies through M&A of subsidiary-type GAs or GAs.

Choi Jae-beom, Vice President and Insurance Industry Leader, said, "With the restructuring of recruitment commissions and the enforcement of the Financial Consumer Protection Act, efforts for complete insurance sales, contract maintenance, and soundness management are becoming more important," and predicted, "Whether insurers secure professional and sound sales channels will determine their competitiveness."

He particularly emphasized, "Considering the structural change of separation of manufacturing and sales within the insurance industry simultaneously, insurers should actively consider strengthening the intrinsic competitiveness of insurance products, establishing or expanding subsidiary-type GAs, and balanced multi-channel strategies between professional face-to-face channels and non-face-to-face channels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)