Starting April 14 Next Year: 'Small and Medium Enterprise Retirement Pension Fund System'

Establishing Fund Committee with Voting Rights Like National Pension

Launch Ceremony of Implementation Task Force on 21st... Minister of Employment: "Ensuring Workers' Retirement Security"

[Sejong=Asia Economy Reporter Moon Chaeseok] To increase the subscription rate of retirement pensions for small and medium-sized enterprises (SMEs) with 30 or fewer employees, the government is forming a joint task force with the Korea Workers' Compensation and Welfare Service and beginning full-scale preparations for the implementation of the Small and Medium Enterprise Retirement Pension Fund System (SME Retirement Fund System). Once the system is implemented on April 14 next year, the retirement funds of workers at SMEs with 30 or fewer employees will be pooled to create a joint fund managed by the Service. Similar to the National Pension Service, a Fund Operation Committee (Fund Committee), the highest decision-making body for fund management, will be established to deliberate and decide on key decision-making rights (voting rights) such as target rates of return, thereby establishing a governance structure, according to the government's plan. If the government's plan proceeds as intended, the adoption rate of retirement pensions among SMEs, which was 24% in 2019, is expected to rise to 43% by 2029.

The Ministry of Employment and Labor announced that it has formed a joint task force with the Service and started preparations for the system's introduction from the 21st. With the amendment of the 'Workers' Retirement Benefit Guarantee Act' on the 24th of last month, the SME Retirement Fund System will be implemented from April 14 next year. The system is a public pension service that pools the individual retirement funds of workers at SMEs with 30 or fewer regular employees to create a joint fund managed by the Service. The system is being implemented to increase the subscription rate of retirement pensions among SME workers. At the launch ceremony held on the day, the Service announced, "We aim to enroll about 700,000 SMEs within six years."

Once the system is introduced, experts will be able to manage pensions similarly to the private sector's defined contribution (DC) asset management system. In other words, instead of receiving a lump sum retirement payment after retirement, the trend of external experts managing workers' entrusted assets during their employment will expand. To this end, the Ministry of Employment and Labor and the Service plan to utilize an Outsourced Chief Investment Officer (OCIO) approach in the early stages of the system's establishment.

The government emphasizes that, like advanced countries such as Japan and the United Kingdom, Korea should also increase the retirement pension subscription rate of low-income workers and manage assets systematically. The government believes that workplaces with 30 or fewer employees have too few personnel and small fund sizes, lacking the capacity to manage returns individually.

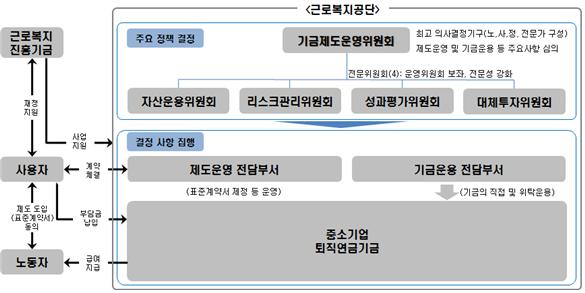

Small and Medium Enterprise Retirement Pension Fund Management System. (Source: Ministry of Employment and Labor)

Small and Medium Enterprise Retirement Pension Fund Management System. (Source: Ministry of Employment and Labor)

After the SME Retirement Fund System is implemented, the government plans to operate assets by establishing a Fund Committee, the highest decision-making body similar to the National Pension Service. The Fund Committee will be composed mainly of 10 to 15 experts from labor, management, and government sectors. It will exercise key voting rights necessary for fund management, such as setting target rates of return. The National Pension Service holds about ten Fund Committee meetings annually at the Plaza Hotel in Jung-gu, Seoul, to make major investment decisions and set target returns, and the SME retirement pension will be managed similarly.

Additionally, to increase the number of initial subscribing companies, the government plans to support part of the employer's contribution and the operating costs of the fund system. As of the end of last year, the Service's retirement pension reserves amounted to about 3 trillion won, and the government's initial goal before the system's implementation is reportedly to secure at least about 1 trillion won. A Ministry of Employment and Labor official explained, "The target of '1 trillion won' is not fixed," adding, "We need to consider how much financial support the government will provide depending on the initial subscription rate."

The task force for the SME Retirement Fund System will work over the next year on tasks such as designing operations, revising subordinate laws and regulations, and raising public awareness. Additionally, a fund establishment advisory group of 10 experts will be formed to discuss fund management, direct and indirect asset management methods, and payment policies. Minister of Employment and Labor Lee Jae-gap said, "We expect the SME Retirement Fund System to play a pivotal role in securing workers' retirement income in the future," and added, "The government will actively support the successful establishment of the system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.