[Asia Economy Reporter Park Jihwan] Last year, the net income of domestic securities firms' overseas local subsidiaries increased by nearly 6% compared to the previous year. By region, profits were recorded in Hong Kong and Vietnam through commission income and other sources. On the other hand, losses were incurred in China, Singapore, and Myanmar due to operational restrictions on local subsidiaries and increased selling and administrative expenses from new market entries.

According to the 2020 overseas branch business performance of domestic securities companies announced by the Financial Supervisory Service on the 20th, the net income earned by 14 domestic securities firms from 70 overseas local branches last year was $197.3 million (approximately 214.7 billion KRW). This figure represents a 5.6% increase from the previous year. Despite COVID-19, the trend of growth was maintained due to factors such as a global stock market boom. In particular, it is analyzed that large securities firms steadily generated profits not only in Hong Kong but also in emerging Asian markets such as Vietnam and Indonesia.

Looking at the net income scale by region, Hong Kong was the largest with $110.1 million. This was followed by Vietnam ($40.9 million), India ($15.6 million), Indonesia ($13.3 million), the United Kingdom ($11.9 million), Thailand ($5.9 million), Brazil ($1 million), the United States ($400,000), Cambodia ($300,000), and Mongolia ($100,000).

On the other hand, China recorded a loss of $1.4 million. Myanmar and Singapore also posted losses of $400,000 and $300,000 respectively. A Financial Supervisory Service official explained, "Losses occurred in three countries including China due to restrictions on business scope and increased selling and administrative expenses from new market entries," adding, "The local subsidiary in China is registered as a general advisory company with the Ministry of Commerce rather than a financial investment company licensed by the China Securities Regulatory Commission, which has limited its operations."

As of the end of last year, 14 domestic securities firms had expanded overseas. They operate a total of 70 overseas branches, including 56 local subsidiaries and 14 overseas offices, across 14 countries. By region, Asia accounts for the majority with 13 in China, 9 in Vietnam, 8 in Hong Kong, and 8 in Indonesia. They also operate overseas branches in the United States (11), the United Kingdom (4), and Brazil (1). Among the firms, Mirae Asset Daewoo had the most overseas branches with 16, followed by Korea Investment & Securities (10), NH Investment & Securities (8), and Shinhan Financial Investment (7).

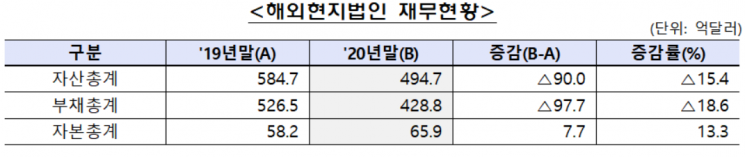

Although the scale of overseas local subsidiaries shrank last year, their equity capital increased, indicating a strengthening of their financial soundness. The total assets of securities firms' overseas local subsidiaries at the end of last year amounted to $49.47 billion (53.8 trillion KRW), down 15.4% from the previous year-end. Equity capital increased by 13.3% to $6.59 billion (7.2 trillion KRW).

A Financial Supervisory Service official stated, "We plan to strengthen the monitoring system to proactively identify potential risk factors that may arise from overseas expansion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)