Excellent Returns Across All Sectors Including DB, DC, and Individual IRP

[Asia Economy Reporter Minwoo Lee] Shin Young Securities has ranked first in retirement pension returns for two consecutive quarters across all sectors including Defined Benefit (DB), Defined Contribution (DC), and Individual Retirement Pension (IRP).

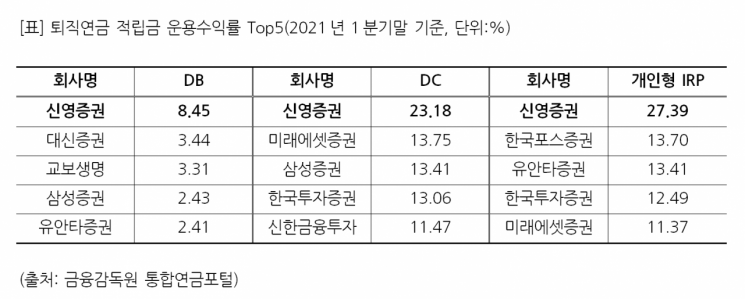

Shin Young Securities announced on the 20th that as of the end of the first quarter of this year, following the end of last year, it recorded the highest one-year return among all providers. According to the Financial Supervisory Service's Integrated Pension Portal, as of the end of last month, Shin Young Securities' one-year returns for Individual IRP and DC were 27.39% and 23.18%, respectively. Shin Young Securities is the only provider to exceed a 20% return. The DB return also recorded the highest at 8.45%.

A representative from Shin Young Securities stated, "Our long-accumulated expertise in long-term, value, and dividend investing allowed us to propose portfolios tailored to customers' investment goals and preferences, which proved effective," adding, "We will continue to leverage our strengths in portfolio rebalancing management."

Meanwhile, the Shin Young Target Date Fund (TDF), exclusively sold by Shin Young Securities as one of the retirement pension products, surpassed 10 billion KRW in assets within just two months of its launch. The Shin Young TDF is a product developed in collaboration with Shin Young Asset Management and Mercer Asset Management, the world's leading outsourced CIO company based in the United States. Mercer selects the best asset managers worldwide by asset class to construct and manage the portfolio. Shin Young Asset Management incorporates these Mercer-managed products in a fund of funds structure.

A Shin Young Securities representative explained, "The Shin Young TDF is a favorable product for customers who want to prepare retirement funds based on a long-term retirement plan or wish to reduce the volatility of their pension assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.