[Asia Economy Reporter Lee Seon-ae] The "earnings-driven market" where "stock prices are a function of earnings" has begun. As the annual net profit forecast for KOSPI-listed companies surpassed 140 trillion won, the KOSPI also exceeded the 3,200 level, closely approaching the January peak of 3,466.23. Accordingly, in a "stock-specific market" where stocks with earnings momentum perform well, attention should be paid to stocks with significant gaps between earnings and stock prices (the difference between the highest stock price and the current stock price) among those showing earnings improvement.

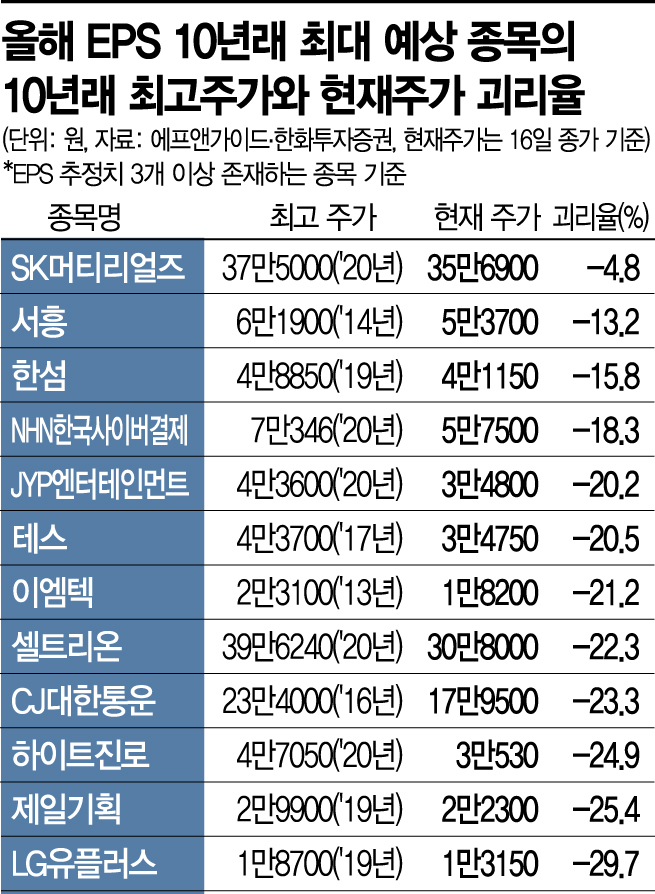

According to financial information provider FnGuide on the 20th, among stocks with three or more earnings per share (EPS) estimates, those expected to have the highest EPS in 10 years but have not reached their 10-year peak prices include SK Materials, Seohung, Handsome, NHN KCP, JYP Entertainment, TES, EM Tech, Celltrion, CJ Logistics, Hite Jinro, Cheil Worldwide, and LG Uplus.

For SK Materials, the 10-year peak price was 375,000 won recorded in 2020, and compared to the current price of 356,900 won (as of the closing price on the 16th), the gap rate is -4.8%. Seohung recorded its peak price of 61,900 won in 2014, with a current price gap rate of -13.2%. Handsome also surged to 48,850 won in 2019, but the gap rate with the current price is -15.8%. NHN KCP’s gap rate between its peak and current price is -18.3%. JYP Entertainment, TES, EM Tech, Celltrion, CJ Logistics, Hite Jinro, Cheil Worldwide, and LG Uplus all have gap rates exceeding -20%. Notably, LG Uplus has the largest gap. LG Uplus rose to 18,700 won in 2019 but currently remains around 13,000 won. Compared to the closing price of 13,150 won on the 16th, the gap rate is -29.7%.

Researcher Ahn Hyun-guk of Hanwha Investment & Securities advised, "Among all listed companies, attention should be paid to stocks whose expected EPS this year is the highest since 2011 but whose current stock price gap compared to the highest price during the same period exceeds -10%, or whose peak price was not reached this year."

The securities industry forecasts that the KOSPI will surpass 3,500, considering forward EPS. Daishin Securities stated that the KOSPI is at 3,630, reflecting a 12-month EPS of 240 won and a target price-to-earnings ratio (PER) of 15.1 times. Researcher Lee Kyung-min of Daishin Securities predicted, "The stock market in the second half of this year will be a tug-of-war between growth fundamentals and discount rates such as inflation and interest rates. After the second quarter, fundamental momentum will outweigh discount rates, leading to a macro-fundamental market."

Meritz Securities also presented an optimistic analysis that the KOSPI net profit could improve to 160 trillion won by 2022 due to continued upward revisions in earnings forecasts, suggesting the upper band of the index at the 3,500 level. Researcher Kang Bong-joo of Meritz Securities stated, "After a significant earnings decline of over 40% in 2019, a long-term trend of high earnings growth is expected from 2020 to 2022. Even considering the possibility of some downward revisions in forecasts depending on the macro environment, there is considerable room for stock market growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.