Lack of Guidelines Leads to Desperate Measures

Increasing Paperwork in Product Descriptions Goes Against the Times

Establishing Safe Financial Products Remains Elusive

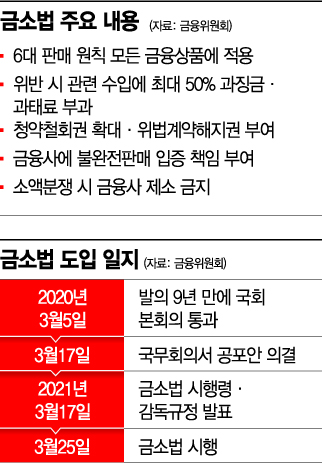

[Asia Economy Reporters Kiho Sung, Seungseop Song] "The atmosphere at branches has completely changed compared to before the Financial Consumer Protection Act came into effect. Even when customers complain about the more complicated and lengthened product sales procedures, we can only apologize. With continuous additional guidelines to learn and work to do, it feels like ten bodies are not enough." (Counter staff at Bank A in Jung-gu, Seoul)

"Do you have enough time? Although automobile insurance is mandatory, it is subject to the Financial Consumer Protection Act. It will take longer than before." (Auto insurance sales representative at Insurance Company B)

On the 19th, one month before the Financial Consumer Protection Act enforcement (March 25), frontline branches of commercial banks still voiced concerns and complaints. Employees, lacking clear guidelines, had to request confirmation from headquarters when problems arose during product explanations or contract preparations, or they were uneasy due to inadequate explanations. They also continued to face difficulties calming customers who complained about the extended product subscription time. A representative from Bank C in Yeouido, Seoul, said, "Our branch has only three employees qualified to sell funds, so other department staff cannot assist. Although authorities urge simplification, we explain products via FM due to liability concerns in case of future losses."

In some branches, customers were advised to complete procedures online, saying there was no need to listen to explanations from branch staff one by one even if they visited the branch. A representative from Bank D in Seodaemun-gu, Seoul, hinted, "After the Financial Consumer Protection Act, to subscribe to an Individual Retirement Pension (IRP), you must call the National Health Insurance Service to receive related documents by fax. If you subscribe via the mobile application (app), you do not need to receive a confirmation letter, so we request customers to handle it entirely online." Among the issued documents, unlike before, a section was added to confirm whether the customer has sufficiently listened to the explanation of the applied contract details and products from the solicitor and received the explanatory documents and key explanation documents.

The anticipated establishment of ‘safe financial products’ is still a distant prospect. A financial holding company official lamented, "Currently, all departments related to the Financial Consumer Protection Act are focusing on customer response and reviewing existing products," adding, "There is no capacity to create new products."

With the so-called ‘cross-selling’?subscribing to funds or insurance within one month before or after taking out a loan at the same bank?becoming difficult, sales are also disrupted. The financial sector demands improvements, calling the response excessive, but the Financial Services Commission refuses to ease restrictions, stating that loans can be bundled with other financial products.

Field sales staff complain about work overload. An auto insurance sales representative at Insurance Company B said, "Time is life in this job, but the explanation time has significantly increased, and the documents we have to carry have nearly doubled. The number of visits to the branch has also increased, causing fatigue and sales burdens." Regarding insurance, there have been cases where some customers, after disclosing pre-existing conditions on the application form, filed complaints claiming that the agent arbitrarily wrote the disclosure content when they could not receive insurance benefits, so they must be even more cautious with other products.

There are also criticisms that this runs counter to ESG (Environmental, Social, and Governance) initiatives actively promoted in the financial sector. A bank employee said, "Although explanations can be given using videos or tablet PCs, many elderly customers prefer paper. Even when selling non-investment products such as deposit/withdrawal and subscription passbooks, document delivery is required, and even if text messages or emails are sent, customers may claim they did not check them, so paper usage will significantly increase for the time being."

Confusion is expected to continue as detailed guidelines from financial authorities have yet to be prepared. A financial sector official said, "The financial authorities and related industries have formed an implementation task force and are responding accordingly, but it will take much more time to reduce confusion on the ground," adding, "Even after detailed guidelines are created, additional suggestions and complaints will inevitably continue to emerge."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)