[Asia Economy Reporter Hyungsoo Park] As SK Innovation, which reached a dramatic agreement with LG Energy Solution, is expected to continue its investment in expanding its battery plant in Georgia, USA, expectations are also growing for Yuil Enertech's orders for secondary battery assembly equipment.

Yuil Enertech is a company that develops notching equipment and stacking equipment necessary for the secondary battery assembly process. The lithium-ion secondary battery manufacturing process is divided into △the electrode process, which mixes active materials to make electrodes △the assembly process, which forms the cathode and anode electrodes?raw materials produced through the electrode process?into a single battery cell △and the activation process, which adds electrical characteristics to the battery cell to produce a battery module pack that functions as a motor installed in electric vehicles.

Notching equipment is a facility that shapes the tabs of the cathode and anode electrodes, cuts them into sheet form, and loads the electrodes into magazines. The stacking equipment is a machine that stacks the sheet-type electrodes separated into cathode and anode at the notching machine. A separator is placed between the cathode and anode electrodes to distinguish them, producing a single jelly roll form.

Yuil Enertech succeeded in commercializing the world's first high-speed wide-width notching machine necessary for producing high-efficiency batteries for electric vehicles. Through continuous research and development, it increased the notching machine speed from 180 PPM in 2017 to 240 PPM in 2019. The company is striving to mass-produce notching machines with a production speed of 260 PPM.

Yuil Enertech shows a high sales dependence on SK Innovation, its major client. SK Innovation builds facilities by narrowing down equipment suppliers necessary for each process to one or two companies, considering process efficiency and post-management convenience. Yuil Enertech has been recognized by SK Innovation for its high technology and competitiveness and currently holds a monopoly in the notching machine sector. Notching machines are divided into the roll-to-roll method used by LG Chem and Samsung SDI and the roll-to-sheet method used by SK Innovation. Yuil Enertech mainly supplies notching machines using the roll-to-sheet method.

Yuil Enertech secured an order for notching machines to be installed at SK Innovation's Georgia Plant 1 in the USA. The Georgia Plant 1 is expected to conduct trial production within this year. Some notching machines were supplied last year, and revenue from these has been recognized. SK Innovation is constructing Georgia Plant 2 with a capacity of 11.7 GWh, aiming for mass production in 2023. If the expansion proceeds as planned, the USA will handle 21.5 GWh, accounting for 25.3% of SK Innovation's total target production capacity of 85 GWh in 2023. Given the agreement between SK Innovation and LG Energy Solution, investment in Plant 2 is expected to continue, raising expectations for additional orders for Yuil Enertech.

Separately from the expectation of additional orders from SK Innovation, Yuil Enertech continues efforts to resolve the risk of sales concentration. The company is developing wide-width stacking machines, medium-to-large roll-to-roll notching machines, and small battery notching machines. It is also expanding into fuel cell equipment for hydrogen fuel cell production and energy storage system (ESS) battery equipment.

Jongseon Park, a researcher at Eugene Investment & Securities, said, "Yuil Enertech's notching equipment has secured the industry's best productivity and stability," adding, "They plan to develop prismatic roll-to-roll notching equipment this year, focusing on pouch-type roll-to-sheet." He continued, "They will enter the wide-width battery market centered on next-generation narrow-width types," and added, "They plan to complete the development of integrated inline equipment capable of processes from notching to stacking by the end of this year."

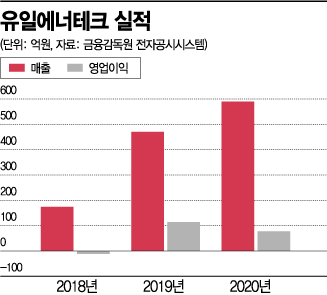

Yuil Enertech recorded sales of 59 billion KRW, operating profit of 7.7 billion KRW, and net profit of 4.8 billion KRW last year. Sales increased by 25.5% compared to the previous year. Performance improved as orders for secondary battery manufacturing equipment specialized for electric vehicles increased, mainly in overseas markets. As of the end of last year, the consolidated debt ratio and borrowings dependency were 101% and 18%, respectively, maintaining a sound financial structure. The company holds 3.253 billion KRW in cash and cash equivalents and 27.7 billion KRW in current assets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.