Ministry of Land Launches Real Transaction Investigation in Overheated Local Areas like Changwon and Cheonan

On the 7th, Dedicated Regular Organization 'Real Estate Transaction Analysis Planning Team' Established for Analysis and Investigation

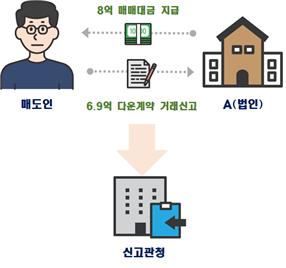

A case where a corporation concentrated on purchasing 10 apartments through an under-the-table contract.

A case where a corporation concentrated on purchasing 10 apartments through an under-the-table contract.

[Asia Economy Reporter Kangwook Cho] #. Real estate rental and development corporation A concentrated on purchasing 10 apartments located in Dalseo-gu, Daegu over a two-month period starting from September last year. However, despite the actual transaction amount being 800 million KRW, a down contract was written and reported at 690 million KRW, raising suspicions of tax evasion due to false price reporting during the multi-home purchase process.

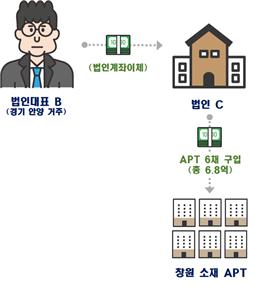

A case where an outsider purchased multiple low-priced houses using a corporate name.

A case where an outsider purchased multiple low-priced houses using a corporate name.

#. Mr. B, residing in Anyang, Gyeonggi Province, purchased six apartments in Seongsan-gu, Changwon over five months starting from June last year, with a total amount of approximately 680 million KRW. During the purchase process, the entire transaction amount was transferred to the account of corporation C, where he is the representative, and the contract and report were made under corporation C's name.

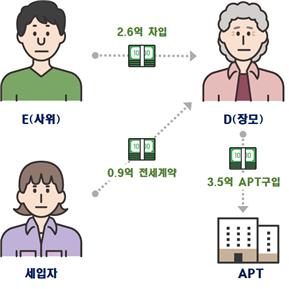

Suspicious Case of Tax Evasion through Borrowing between Related Parties (Mother-in-law and Son-in-law).

Suspicious Case of Tax Evasion through Borrowing between Related Parties (Mother-in-law and Son-in-law).

#. Mr. D, in his 60s, during the purchase of an apartment in Nam-gu, Ulsan, borrowed the entire amount of approximately 260 million KRW, excluding the jeonse succession deposit of 90 million KRW, from his son-in-law E to pay the transaction amount of about 350 million KRW, raising suspicions of disguised gifting.

The Ministry of Land, Infrastructure and Transport announced on the 19th that it identified a total of 244 suspected illegal cases through a planned investigation of actual transactions in major overheated local areas conducted over the past three months. The Ministry plans to notify relevant departments such as local governments, the National Tax Service, and the National Police Agency to verify the suspicions. This investigation targeted 15 major areas including Changwon, Cheonan, Jeonju, Ulsan, and Gwangju, where overheating trends were concentrated.

Among 25,455 transactions reported from September to November last year in overheated local real estate markets, the Ministry identified 794 transactions where non-residents purchased three or more houses within the last six months, 14 cases of minors purchasing houses without sufficient self-funding ability, and a total of 1,228 abnormal transactions, initiating an investigation. As a result, 58 cases suspected of tax evasion and 162 cases suspected of violating the Real Estate Transaction Reporting Act were confirmed, totaling 244 suspected illegal cases.

In particular, this investigation uncovered 25 cases of false reporting involving contract dates and transaction prices where the same corporation purchased multiple apartments in a short period through down contracts, as well as 6 cases where non-residents used corporate names to purchase multiple low-priced houses, totaling 73 cases of disguised or illegal acts using corporations.

The Ministry plans to notify the National Tax Service of suspected tax evasion cases identified as violations of related laws, and notify the Financial Services Commission and the Financial Supervisory Service of suspected violations of loan regulations to enable tax evasion analysis (and tax audits if necessary), financial company inspections, and loan recovery. Cases suspected of violating the Real Estate Transaction Reporting Act, such as false reporting of contract dates and prices, will be reported to local governments for imposition of fines, and cases suspected of criminal acts such as name trusts will be referred to the National Police Agency for investigation.

In particular, since February, the Ministry has been conducting a planned investigation into so-called 'actual transaction price boosting' cases, where false reports were made and then canceled for the purpose of manipulating market prices. If criminal charges such as 'self-dealing' are confirmed based on the investigation results, the cases will be referred to the relevant police agency for investigation.

Since February last year, the Ministry has operated the 'Real Estate Market Illegal Activity Response Team' as a temporary organization to investigate actual transaction reports and conduct criminal investigations. To effectively respond to various types of real estate market disturbances, the response team was recently regularized as a planning unit, launched on the 7th, with strengthened personnel, expertise, and market analysis functions.

Due to concerns about concentration of authority when conducting both actual transaction investigations and criminal investigations within the same organization, the recent organizational reform excludes criminal investigation functions and strengthens market trend monitoring, analysis, and actual transaction investigation functions.

In particular, the planning unit will closely monitor real estate transaction volumes, prices, and abnormal transaction trends by region to respond promptly to market overheating and abnormal signs. It will also expand actual transaction investigations, which have mainly focused on housing transactions, to include land transactions, conducting detailed investigations into the appropriateness of reports and transparency of funding processes for speculative land purchases by non-residents and other abnormal land transactions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.