Global Semiconductor Equipment Investment Hits $125 Billion This Year

South Korea Ranks No.1 for 3 Consecutive Years as Semiconductor Equipment Exporter to the US

Expectations Rise for Improved Performance of Korean Semiconductor Equipment Firms Focused on US Exports

[Asia Economy Reporter Suyeon Woo] This year, global semiconductor companies are expected to make the largest-ever capital investments, raising expectations for improved performance among domestic semiconductor equipment companies. Domestic firms are focusing on exports to the U.S. market, where large-scale semiconductor capital investment led by the government is anticipated.

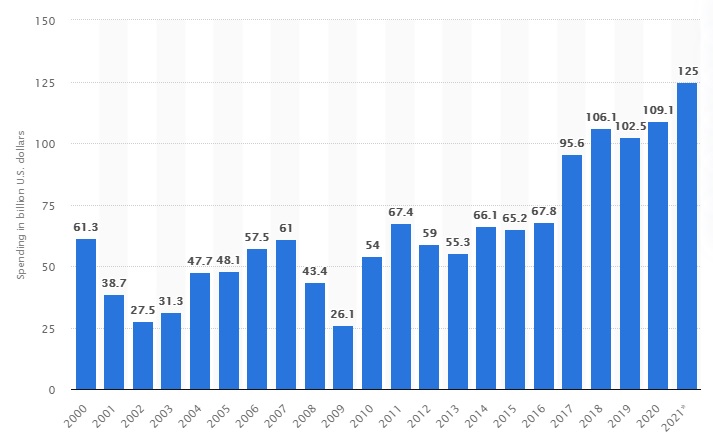

According to global data research firm Statista on the 19th, the global semiconductor industry's capital investment amount is projected to reach $125 billion this year, marking an all-time high. This represents an approximately 15% increase compared to the previous year, and it is the first time since 2017, the beginning of the 'supercycle,' that global semiconductor capital investment has grown by more than 15%.

Governments in the U.S., Europe, China, and other countries have recently expanded domestic investments, advocating semiconductor self-reliance amid worsening semiconductor supply shortages. The U.S., where the most concrete plans have been established first, is encouraging investment attraction led by the government.

Intel, which has declared its return to foundry business, announced an investment plan worth $20 billion (22 trillion KRW), and Taiwan's TSMC has raised its capital investment plan to $30 billion (33 trillion KRW) this year, pushing forward with the establishment of a factory in Arizona, U.S. Samsung Electronics also plans to pour about 35 trillion KRW into capital investment this year alone, including $17 billion (20 trillion KRW) for expanding its U.S. factory.

Following these plans, domestic semiconductor equipment companies securing export routes mainly to the U.S. market are gaining attention. Wonik IPS supplies deposition equipment that coats films on semiconductors to Samsung Electronics, and Hanmi Semiconductor exports key equipment to TSMC's OSAT (Outsourced Semiconductor Assembly and Test) contractors. PSK, a domestic company with Samsung Electronics as its largest client, stands shoulder to shoulder with U.S. Lam Research, the industry leader in semiconductor front-end equipment market.

According to the Korea International Trade Association, Korea's semiconductor equipment exports to the U.S. market reached $118.13 million last year, marking the top position for three consecutive years. Until 2017, Taiwan was the leading country in semiconductor equipment exports to the U.S., but since 2018, Korea's export volume has grown to more than twice that of Taiwan, securing the number one spot.

Some domestic companies are focusing on the Chinese market, where used equipment transactions are active due to U.S. trade sanctions. Surplus Global operates a platform business that trades thousands of used semiconductor equipment annually based on a global network.

Lee Euntaek, a researcher at KB Securities, said, "Regardless of the success of the U.S. semiconductor production expansion strategy, it will clearly be a positive factor for semiconductor equipment companies," adding, "Considering not only the U.S. strategy but also China's countermeasures, it is time to pay attention to semiconductor equipment companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.