Hints of a 2010 Bull Market After the Global Financial Crisis

Stocks with Profit Growth Within Sectors Experiencing Profit Decline in the Second Half... Korea Financial Group & OCI

Top Market Cap and Stocks Narrowing Sales Gap... Kakao & Hyundai Mobis

Companies Reducing Debt at Year-End... Hyundai Mipo Dockyard & SFA

On the 16th, when the KOSPI index surpassed the 3,200 mark during the session, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. The KOSPI started at 3,194.08, down 0.25 points (-0.01%) from the previous close, and is showing an upward trend. Photo by Moon Honam munonam@

On the 16th, when the KOSPI index surpassed the 3,200 mark during the session, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. The KOSPI started at 3,194.08, down 0.25 points (-0.01%) from the previous close, and is showing an upward trend. Photo by Moon Honam munonam@

[Asia Economy Reporter Ji Yeon-jin] As the domestic stock market, which had been stagnant since the beginning of the year, shows signs of rising again, attention is focused on stocks that will lead the new bull market. The securities industry is looking for hints from the leading stocks of the 2010 stock market, when the KOSPI index surged by 22% after the global financial crisis.

According to the securities industry on the 19th, the KOSPI, which plummeted due to the global financial crisis triggered by the collapse of Lehman Brothers in the US in 2008, surged 50% in 2009 and rose an additional 22% in 2010. The KOSPI, which experienced a major crash again due to COVID-19, recorded a 30% increase compared to the end of the previous year last year, and is currently up 11% this year.

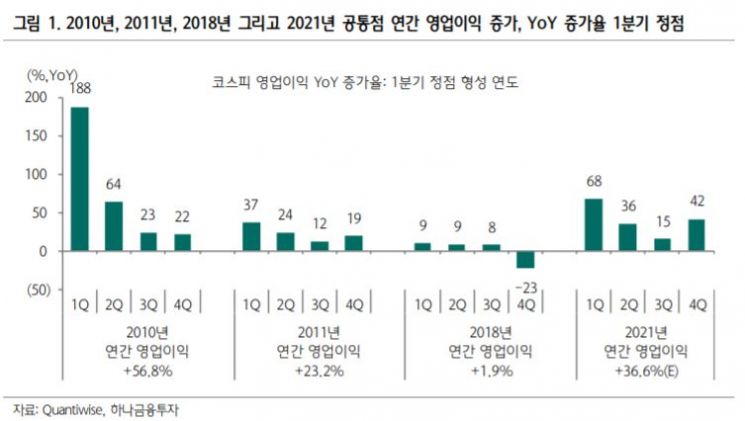

Moreover, this year, the annual operating profit of domestic companies is expected to increase compared to the previous year, but the growth rate is expected to slow down after peaking in the first quarter of this year. This is similar to 2011 when the KOSPI's annual operating profit growth rate was 188% in the first quarter, then gradually decreased to 64% in the second quarter, 23% in the third quarter, and 22% in the fourth quarter.

Based on this, it is analyzed that among stocks expected to see a decrease in profits in the second half compared to the first half of this year, companies expected to show profit growth will likely emerge as leading stocks. In fact, IT hardware, centered on Samsung Electro-Mechanics and LG Innotek, played a leading role until the first half of 2009-2010, but these companies dropped out of the leading stocks due to profit declines in the second half, while Go Young in the same industry saw stock price increases due to profit growth. Among securities and chemical sectors, which showed significant earnings improvement in the first quarter this year, Korea Financial Group and OCI are expected to have higher profit growth rates in the second half.

There is also advice to pay attention to companies within leading industries where the gap between the market capitalization leader and the second in sales is expected to narrow. In 2010, in the automobile, chemical, and refining industries where profit share increased, the leading stocks were not the second-ranked companies in the industry but the market capitalization leaders with reduced sales gaps with the second-ranked companies (Kia, Kumho Petrochemical, and S-Oil). Lee Jae-man, a researcher at Hana Financial Investment, said, "Among final consumer goods expected to increase profit share in this year's domestic stock market, in internet and automobile sectors, companies expected to narrow the gap with the market capitalization leader are Kakao and Hyundai Mobis," adding, "In cyclical stocks such as semiconductors and secondary batteries, SK Hynix, Rino Industrial, Iljin Materials, and Solbrain are expected to surpass the operating profit margins of the market capitalization leaders."

The second half of 2010 saw a revival of the shipbuilding industry due to global economic improvement. At that time, although the KOSPI's debt size steadily increased, shipbuilding proceeded with debt reduction measures, which led to significant sales improvement and a large increase in operating profit. Similarly this year, it is pointed out that attention should be paid to industries where the debt size at the end of last year decreased compared to the highest level since 2018. In the shipbuilding and machinery sectors where debt size has shrunk, companies such as Hyundai Mipo Dockyard and SFA, which have rapidly reduced debt, are mentioned as likely to emerge as leading stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.