Visiting and Phone Consultations at 4 Laborer Support Centers

Reflecting Platform and Freelancer Workers' Requests Ahead of May Comprehensive Income Tax Filing

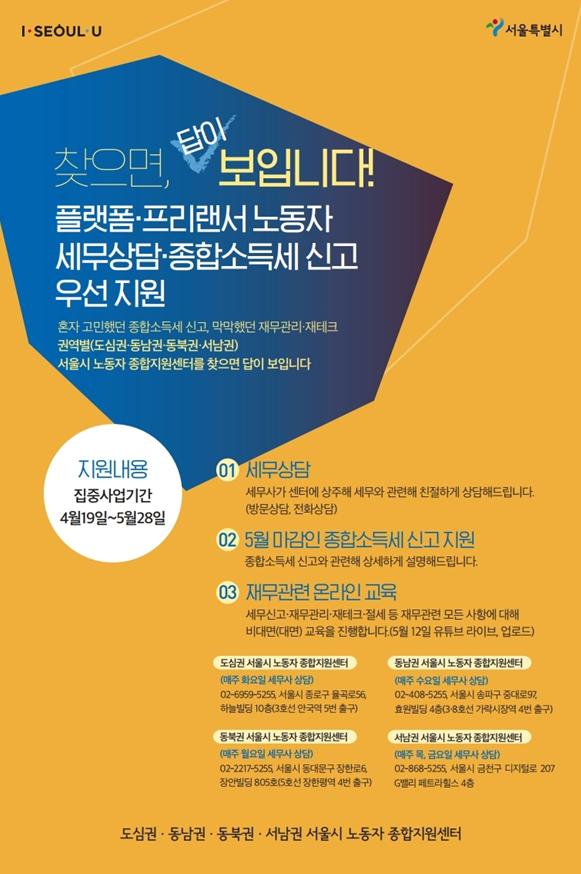

[Asia Economy Reporter Lim Cheol-young] On the 19th, the Seoul Metropolitan Government announced that it will begin providing comprehensive income tax filing guidance and various tax consultations for platform and freelance workers who face difficulties in tax reporting. Tax professionals will inform workers in detail about whether they are subject to comprehensive income tax filing, the documents required for filing, the filing process, tax payment methods, tax-saving strategies, and deduction criteria.

Platform and freelance workers who wish to receive consultations can visit or call one of the four nearby Seoul Worker Comprehensive Support Centers. Consultations will be held once or twice a week on designated days until May 28. Additionally, consultations are available through KakaoTalk open chat (#Free Tax Consultation #Worker Comprehensive Support Center #Platform Freelancer Search).

For workers who find it difficult to visit or call, online tax education will be provided starting May 12 via the regional center’s YouTube channel (search for Seoul Worker Comprehensive Support Center). The education will cover essential topics such as what to know when filing comprehensive income tax, required documents, tax-saving methods, tax technology, explanations of government systems, and improvement plans. Real-time Q&A sessions will also promptly address workers’ difficulties.

Currently, Seoul operates a total of 22 ‘Worker Comprehensive Support Centers’ across the city to protect the rights of workers who have experienced unfair treatment or difficulties while working and to provide relief for damages. The centers offer customized consultations and labor law education for workers, and the number of centers is planned to increase to 25 by next year.

Jang Young-min, Labor Policy Officer, stated, “Many workers in platform and freelance sectors who have not been in the industry long or lack extensive tax knowledge have often paid for tax professionals out of pocket or suffered losses by not filing at all, which is why we have started providing tax support. We will continue to listen to the voices of platform and freelance workers who are in legal and institutional blind spots and provide thorough support as needed.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)