[Asia Economy Reporter Minji Lee] With strong performance in the fashion and bag sectors, Louis Vuitton Moet Hennessy (LVMH) posted solid results in the first quarter, and opinions suggest that growth will further expand in the Asian and U.S. markets.

According to industry sources on the 17th, LVMH's first-quarter revenue sharply rebounded in Asia and the U.S., reaching 13.96 billion euros, a 32% increase compared to the same period last year. This significantly exceeded market expectations of 12.73 billion euros. Although the duty-free and Sephora segments underperformed, the strong performance in the fashion accessories sector and growth in the Asian and U.S. markets contributed to these results.

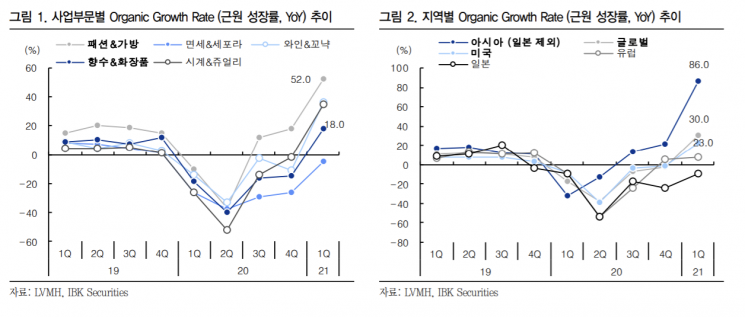

By region, growth expanded significantly centered on Asia and the U.S. Asia (excluding Japan) and the U.S. recorded growth rates of 86% and 23%, respectively, indicating a rapid normalization phase. However, Europe is expected to experience prolonged uncertainty due to COVID-19 beyond initial forecasts.

By business segment, the fashion and bag division, which accounts for nearly 50% of sales and includes key brands such as Louis Vuitton and Dior, grew 45% compared to the same period last year. Researcher Kim Jae-im analyzed, “Although store closures resumed in major European countries in March, negatively impacting sales, store operations normalization and luxury revenge consumption effects in the U.S. and Asia led to a significant increase in purchases.” The duty-free and Sephora segments declined by about 11% compared to last year. The duty-free segment continues to be affected by COVID-19 lockdown measures and is responding through cost reductions such as sales expenses. Sephora showed strong performance in the Chinese market but was affected by store closures in Europe.

With increased demand for wine and cognac, the liquor segment grew 28% compared to the same period last year. IBK Investment & Securities researcher Ahn Ji-young said, “Despite reduced consumption in the entertainment market, wine and champagne saw restocking demand increases due to price hikes,” adding, “Cognac rebounded due to recovery in the U.S. retail market and demand from China influenced by the Lunar New Year.” The perfume and cosmetics segment grew 12% year-on-year, with online growth continuing mainly in core brand basic items. Although the duty-free channel was sluggish, solid growth was maintained through online sales alone.

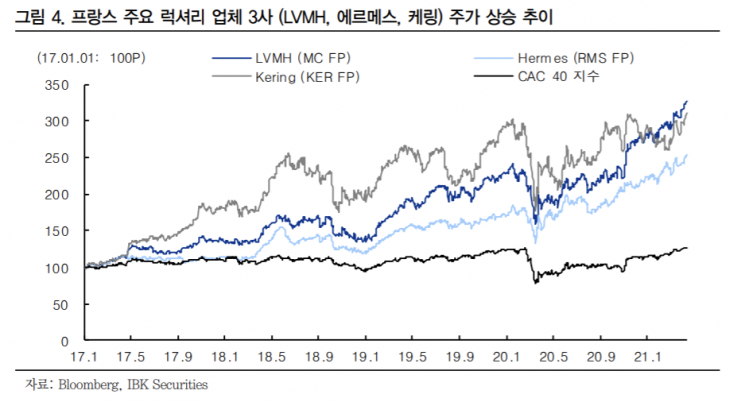

LVMH is expected to achieve further performance improvements reflecting the Tiffany acquisition effect. Expanding the customer base with a lower-priced line compared to existing LVMH jewelry and its popularity in Asia are anticipated to have a positive impact. Although sales growth in the fashion division is expected to slow in the second half compared to the first half due to COVID-19 vaccine effects, considering store normalization effects, no significant damage is expected. Kim Jae-im, a researcher at Hana Financial Investment, explained, “Considering the stable rebound of the most diversified luxury business group, it is judged to have the highest investment attractiveness among luxury operators.”

Additionally, there are opinions that expanding offline channels will strengthen performance momentum in the post-COVID-19 era. Since the end of last year, LVMH has focused on strengthening offline channels for duty-free and Sephora. The duty-free segment opened a Mission Hills duty-free store in Hainan, China, in January this year, and Sephora continues a trend of net store increases. Researcher Ahn Ji-young said, “Sephora plans to open at least 850 stores in China and the U.S. through a joint venture with Kohl’s by 2023,” adding, “Proactive expansion of offline channels will have a positive effect in the post-COVID-19 environment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)