Switched to Hawkish Stance to Catch Real Estate... Negative Impact on Stock Market Too

[Asia Economy Reporter Gong Byung-sun] An analysis has been raised that the Chinese stock market is showing a downward trend as China's easing policies retreat. However, it is expected that if the Chinese stock market joins the global earnings trend, it will become a driving force for the KOSPI's rise.

While global stock markets are booming, China is not riding that wave. Since February, the stock price trends of the U.S. and China have been contrasting. The U.S. S&P 500 index and the domestic KOSPI index are on the rise, but the Shanghai Composite Index is actually falling. In particular, the Dow Jones Industrial Average and the S&P 500 index recorded new all-time highs again on the 16th (local time).

Since the Chinese stock market is not showing strong momentum, South Korea and several other countries are also being affected. Although the U.S. stock market is hitting record highs, the KOSPI has not surpassed its all-time high of 3266.23 recorded in January. Moreover, the stock markets of India and Brazil have also stopped rising and are moving sideways.

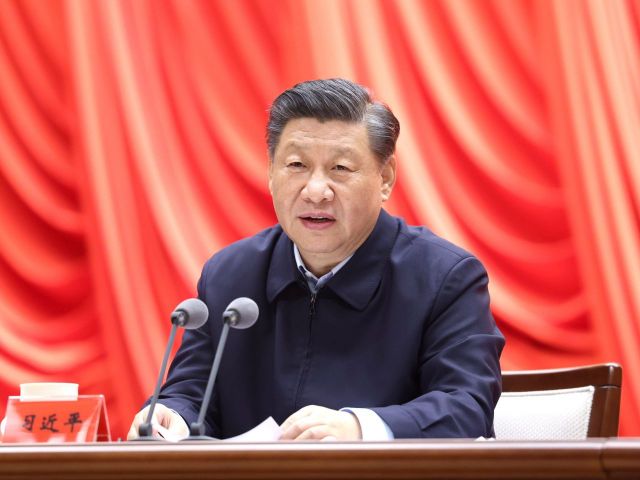

The weakening of the stock market is interpreted as a result of the retreat in China's easing policies. Jo Ik-jae, a researcher at Hi Investment & Securities, explained, "The People's Bank of China has required commercial banks to maintain new loans at the same level as last year," adding, "China's monetary policy is clearly shifting to a more hawkish stance compared to last year." Hawkish refers to economic policies that pursue price stability, interest rate hikes, and fiscal soundness.

China's hawkish stance is due to real estate. According to the National Bureau of Statistics of China, real estate prices in China rose by 8.7% last year. The average housing price also increased for 33 consecutive months. As concerns about a bubble began to emerge in various places, Chinese authorities appear to have introduced strong monetary policies. It seems that policies aimed at controlling real estate are also affecting the stock market.

However, there is also a prediction that the Chinese stock market will join the global earnings trend. As a result of liquidity injections by each country last year, corporate earnings have shown positive results. Researcher Jo said, "There is a clear inflow of funds from investors trying to take advantage of the recent correction in the Chinese stock market as a buying opportunity," adding, "The Chinese stock market will soon participate in the upcoming global earnings trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.