Impact of Chairman Kim Beom-su's 500 Billion Block Deal Sale

Samsung Electronics and Naver Also Decline After Re-listing

Kakao Expected to Trend Upward in the Mid to Long Term

[Asia Economy Reporter Song Hwajeong] Kakao, which was relisted after a stock split, saw its stock price surge on the first day of relisting, rising to 5th place in market capitalization, but turned bearish after just one day. It appears that the news of Chairman Kim Beom-su of Kakao’s board conducting a block trade of stocks worth 500 billion KRW in after-hours trading influenced this.

As of 9:15 a.m. on the 16th, Kakao was trading at 116,500 KRW, down 4,000 KRW (3.32%) from the previous day. On the first day of relisting after the stock split, Kakao closed at 120,500 KRW, up sharply by 7.59%. During the session, it even rose to 132,500 KRW. The surge pushed it to 5th place in market capitalization.

The reason Kakao’s stock price, which seemed poised for continuous growth, turned bearish after just one day is interpreted as the impact of Chairman Kim’s block trade. After the market closed the previous day, Chairman Kim and K Cube Holdings conducted a demand forecast for the sale of Kakao shares worth 500 billion KRW through a block trade. The discount rate ranged from 3.3% to 5.0%, setting the sale price range between 114,500 KRW and 116,500 KRW, discounted from the previous day’s closing price of 120,500 KRW. This block trade is intended to raise funds necessary for donations; earlier in February, Chairman Kim announced plans to donate more than half of his wealth.

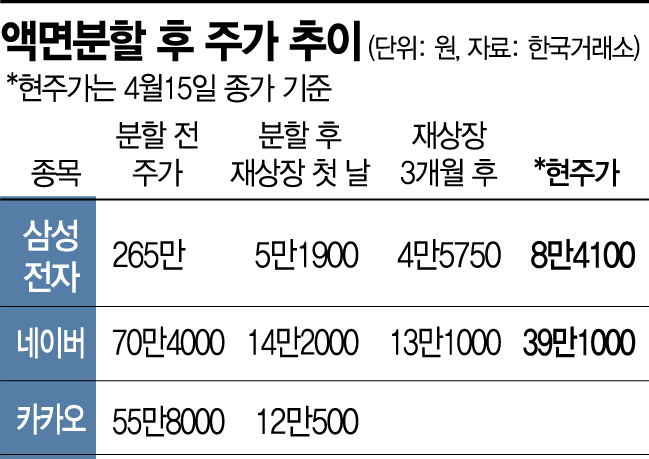

In the short term, concerns about the volume may cause a bearish trend, but Kakao’s stock price is expected to show an upward trend in the mid to long term. Samsung Electronics and NAVER, which also conducted stock splits in 2018, experienced sluggish stock price movements for a while after relisting but then rose significantly. Samsung Electronics’ stock price fell 2.08% on the first day of relisting in May 2018 and dropped below 40,000 KRW by the end of that year. However, the stock price rose afterward, surpassing 90,000 KRW at the beginning of this year. NAVER also had a lackluster stock price trend after relisting. NAVER, relisted in October 2018, rose 0.71% on the first day but then fell for four consecutive days, breaking below 110,000 KRW. Afterward, it gained momentum, with the stock price exceeding 400,000 KRW this year, reaching an all-time high.

With high growth and improved performance, Kakao’s corporate value is expected to continue rising. Choi Gwansoon, a researcher at SK Securities, said, “Reflecting the increase in the number of shares due to the stock split, the launch of Kakao Entertainment, and the expansion of Kakao Pay’s transaction volume, we have raised the target stock price to 140,000 KRW,” adding, “Despite the sharp rise in stock price after the stock split, the mid- to long-term growth story remains valid, and corporate value will continue to increase.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.