Namyang Dairy Products Stock Up 28%·Down 6%

Suspicions of Price Manipulation and Internal Trading

Intent Confirmation May Lead to Fair Trade Act Penalties

[Asia Economy Reporter Park Jihwan] The controversy is growing as Namyang Dairy Products' stock price has been volatile following the announcement of research results on the COVID-19 inhibitory effects of its fermented milk product, "Bulgaris." Individual investors who bought stocks based solely on the company's announcement are now facing significant losses due to the sharp decline in stock prices and are urging financial authorities to investigate, citing violations of the Capital Markets Act.

As of 9:02 a.m. on the 15th, Namyang Dairy Products was trading at 338,000 KRW, down 6.24%. The previous day, the stock price surged as much as 28.68% in early trading but closed at 360,500 KRW, down 5.13%, amid growing doubts about the research announcement.

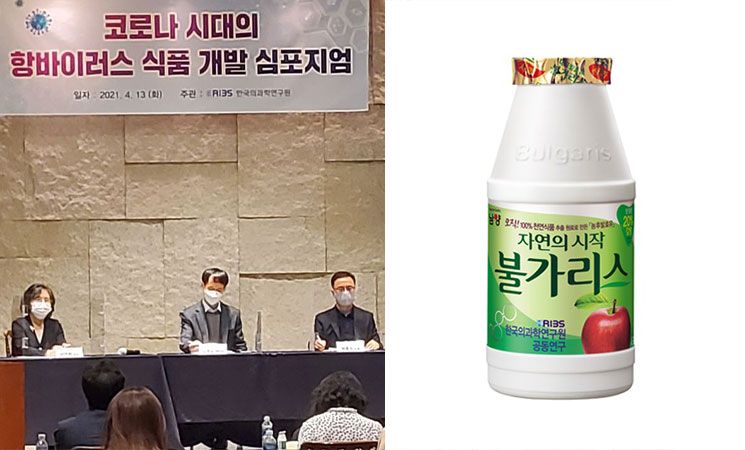

Namyang Dairy Products' stock price has been fluctuating since the announcement on the 13th that Bulgaris is effective in preventing COVID-19. At a symposium, Namyang Dairy Products' Antiviral Immunity Research Institute claimed, "Experimental results on the Bulgaris fermented milk product confirmed a 77.78% reduction effect on the COVID-19 virus." On the day of the announcement, the stock price rose 8.57%. However, the Korea Disease Control and Prevention Agency (KDCA) drew a line on Bulgaris' potential for COVID-19 prevention, stating, "No human subject research was involved."

The market is raising suspicions that there may have been intentions to boost the stock price or insider trading using undisclosed information by Namyang Dairy Products, as the stock price had already risen significantly since the 9th, before the experimental results were announced. Under the Capital Markets Act, acts that omit important information to mislead others and gain financial benefits are considered unfair trading and are prohibited. A financial authority official stated, "If the company distributed and announced false or exaggerated information to induce stock price increases and misled investors, and if there was 'intent' in such acts, it could be punishable under the Capital Markets Act."

If the recent stock price fluctuations result in financial gains for insiders such as major shareholders or executives, it could also be punishable as insider trading using undisclosed information. In this case, two conditions must be met: 'acts that mislead investors' and 'connection to trading.' The first condition, misleading investors, is likely met given the significant market demand and large stock price movements following the distribution of related materials.

The key issue will be proving the connection to trading. A Financial Supervisory Service (FSS) official explained, "For unfair trading to be established under the Capital Markets Act, it is fundamentally required to prove that someone inside the company gained unfair benefits through stock trading, rather than just the act of announcing the research results."

The FSS plans to conduct investigations if any abnormalities are found through initial monitoring by the Korea Exchange or if requests come from prosecution or other investigative authorities. They also stated that investigations into violations of the Capital Markets Act are possible if complaints from investors include specific clues such as information on nominee accounts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)