[Asia Economy Reporter Lee Seon-ae] In the first quarter of this year, the settlement amount for overseas stocks through the Korea Securities Depository (KSD) (purchase + sale amount) was $128.51 billion (approximately KRW 144.1 trillion), marking a 96.5% increase compared to the previous quarter ($65.4 billion). This is the largest quarterly figure since statistics began being compiled in 2011, setting a new record.

According to KSD on the 14th, by market, the settlement amount for U.S. stocks was $119.89 billion (KRW 134.4 trillion), up 98.7% from the previous quarter. This accounts for 93.3% of the total overseas stock settlement volume.

By stock, U.S. stocks dominated the top ranks, including Tesla ($11.87 billion), GameStop ($5.2 billion), Apple ($3.86 billion), SPAC company Churchill Capital ($2.57 billion), and big data analytics company Palantir Technologies ($2.18 billion). Tesla’s settlement amount in the first quarter was $11.87 billion (approximately KRW 13 trillion), a 35% increase from the previous quarter. This amount exceeds half of Tesla’s stock settlement amount for the entire past year.

KSD explained that in addition to large U.S. tech stocks like Apple and Amazon, which have maintained top settlement amounts, stocks influenced by U.S. market issues and policies have also risen to the top, indicating diversification of investment targets.

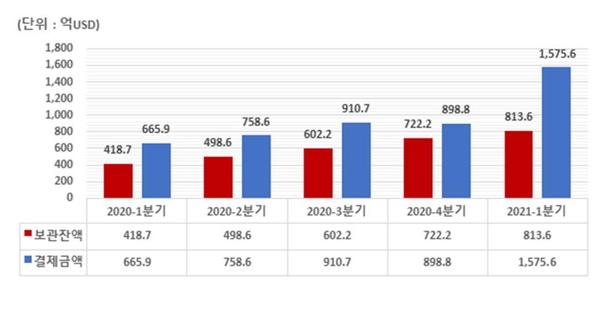

The amount of foreign currency securities held by domestic investors in the first quarter of this year also reached a record high of $81.36 billion (approximately KRW 91 trillion). This amount represents a 12.6% increase compared to the previous quarter’s foreign currency securities holdings balance ($72.22 billion). Notably, U.S. securities accounted for 57.9% of the total holdings balance. Securities from five markets including the U.S., Eurozone, Hong Kong, China, and Japan accounted for 97.4% of the total holdings balance.

In the case of foreign stocks, U.S. stock holdings accounted for 80.3% of the total holdings balance. Tesla held the highest proportion, followed by Nasdaq tech stocks such as Apple, Amazon, Nvidia, and Alphabet A. The holdings amount of the top seven U.S. stocks totaled $17.26 billion (approximately KRW 19 trillion), accounting for 29.9% of the total foreign stock holdings.

KSD stated that due to the significant increase in settlement instructions caused by the expansion of foreign currency securities investment, they will improve the foreign currency securities settlement instruction transmission and reception (SWIFT) system. In particular, they plan to request cooperation to enable foreign currency securities trading through domestic securities firms even on holidays. Additionally, KSD announced plans to select additional foreign custodians for foreign currency securities lending brokerage and to allow investors to use foreign currency securities held as collateral through international securities depositories.

A KSD official said, "We will revise the foreign currency securities deposit and settlement regulations and gather opinions from external research institutions and market participants to prepare more market-friendly foreign currency securities investment support measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.