Free Rocket Delivery for Coupang Free Members... Emart Lowest Price Compensation Points

Lotte Mart Counters with 5x Points... Minimizing Margins with Same Supply Price Competition

Minimal Store Visits for 10-20 Won Cheaper, Concerns Over 'Large Mart = Cheap' Perception

[Asia Economy Reporter Jo In-kyung] The lowest price competition among major retailers is reemerging after more than a decade. While in the early 2000s large marts engaged in a '10-won competition' by offering ultra-low prices, this time the competition is unfolding between e-commerce companies and large marts.

Ultra-low Price Competition Ignited by Coupang's Free Shipping

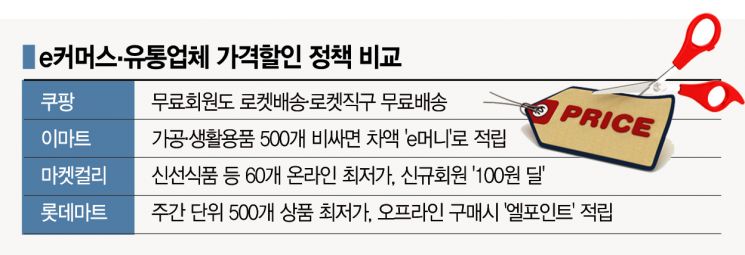

On the 14th, Lotte Mart announced that it would offer 500 daily necessities, which Emart pledged to supply at the lowest price, at the same price and provide members of its mobile app 'Lotte Mart GO' with 5 times more L.POINT rewards when purchasing these products at offline stores. Normally, the basic L.POINT accumulation rate ranges from 0.1% to 0.5% depending on membership grade, but for these products, rates of 0.5% to 2.5% are applied. For a 10,000 won product, customers effectively receive a discount of 50 to 250 won depending on their grade.

The opening salvo of the ultra-low price competition began earlier this month when Coupang started offering unconditional free shipping on 'Rocket Delivery' products, its next-day delivery service. Coupang, which charges 2,900 won monthly for its paid membership, extended free shipping on Rocket Delivery products to non-paying members as well. This effectively lowered product prices by the amount of the shipping fee.

Following this, Emart took action. On the 8th, Emart introduced a 'Lowest Price Compensation Accumulation System' that refunds the price difference as 'e-money' if more than 500 daily necessities are sold at a higher price than competitors. E-money can be used like cash at Emart stores. Emart specifically named Coupang, Lotte Mart, and Homeplus as competitors, igniting the ultra-low price competition.

Market Kurly, aiming for a U.S. stock market listing, also joined in. It increased the number of '100-won deal' items available only to new members from 6 to 10 to attract customers. It also introduced free shipping benefits that provide free shipping time based on the purchase amount. For a purchase of 50,000 won, free shipping is provided for 50,000 minutes (34 days 17 hours 20 minutes) from the purchase date, and for 100,000 won, free shipping lasts 100,000 minutes (69 days 10 hours 40 minutes).

Will the 10-won War Recur?

The retail industry expects marketing effects as major marts and key e-commerce companies jump into the lowest price competition, but they believe it is difficult to gain significant benefits. This is because the selling prices of most of the 500 daily necessities selected for lowest price comparison are similar. Additionally, even if e-commerce companies offering free shipping sell at the same price, they are still at a disadvantage in price competitiveness. However, since it is difficult to withdraw from the already started lowest price competition, the price competition is expected to continue expanding.

An industry insider said, "Popular processed foods and daily necessities have the same supply price at each mart, so companies are effectively competing by minimizing distribution margins," adding, "The price competition between Emart and Lotte Mart reflects their desperation to convey the message to consumers that 'marts are the cheapest' and to prevent offline customers from being taken away by Coupang."

Another insider pointed out, "Nowadays, consumers who value quality and services such as exchange and refund are unlikely to visit other stores just because prices are 10 to 20 won cheaper or to seek compensation by bringing receipts," adding, "Excessive self-undercutting competition could damage the image by reinforcing the perception that 'large marts = cheapness.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)