Foreigners Hesitant About 'Saja Haengjin', Hope for Individual Participation

[Asia Economy Reporter Song Hwajeong] Recently, with the influx of foreign buying, the KOSPI has approached the previous high of the 3200 level. Attention is focused on whether individual investors will join the buying spree following foreigners amid the KOSPI's strong performance.

According to the Korea Exchange on the 14th, the KOSPI closed at 3169.08 the previous day, reaching its highest closing price since the peak of 3208.99 set on January 25. Except for one day this month, the KOSPI has been in the red every day, raising expectations of breaking the previous high. On the same day, it even rose to the 3180 level in early trading.

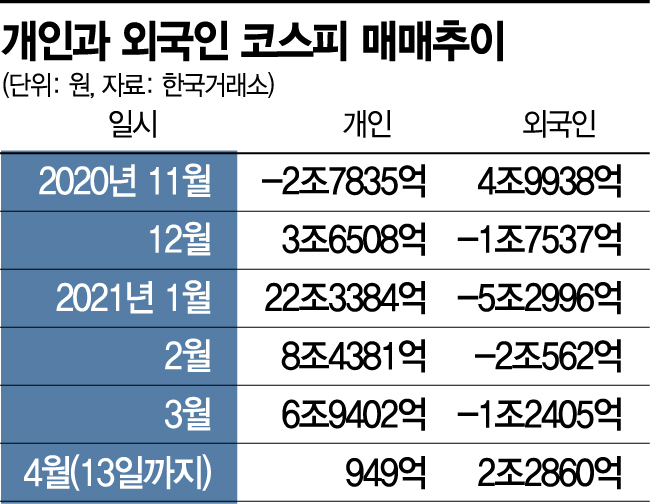

This strong performance of the KOSPI was led by foreigners. After reaching an all-time high in January, the KOSPI entered a correction phase and showed sluggish movement around the 3000 level. However, this month, foreigners turned to buying, starting an upward trend. Foreigners have shown buying pressure on all but two days this month, purchasing a total of 2.286 trillion KRW up to the previous day. Although foreigners switched to surprise buying in November last year, they returned to selling in December and continued to 'sell' until last month.

The return of foreigners is expected to rekindle the subdued individual buying momentum. As the market correction continues, the individual buying that had supported the market has also weakened. Individual net purchases this month amounted to only 94.9 billion KRW. Considering that they bought 2.1932 trillion KRW during the same period last month, the buying power has clearly weakened. Monthly, individuals who net purchased 22 trillion KRW in January reduced their buying scale to the 8 trillion KRW range in February and to the 6 trillion KRW range last month. When the market undergoes a correction during a phase of capital inflow, individuals tend to respond with box-range trading, then shift to a trend-following trading pattern once they judge the price is entering a full-fledged upward trend. This pattern is expected to appear again this time. Previously, in the second half of last year, as the market corrected, individual buying slowed and turned to selling in November. However, when foreigners switched to buying in November, individuals resumed buying in December, leading the KOSPI to break its all-time high. Kim Younghwan, a researcher at NH Investment & Securities, said, "For individuals to return, breaking above the KOSPI 3200 level is important," adding, "The 3200 level is the point where individual stock holdings enter the profit zone, and once this zone is reached, individual investors are likely to buy with greater confidence."

If individuals join in, the KOSPI is expected to challenge the all-time high once again. Researcher Kim predicted, "The KOSPI will first be driven by foreigners to test the previous high of 3200, and then individuals will push it to break the all-time high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.