"Refund Guarantee" "Get More Settlement Money"

Agents and Insurers Turned Agencies Are Aggressive

Insiders Reveal... Insurance Industry Is Troubled

[Asia Economy Reporter Oh Hyung-gil] "I received a full refund for my dollar insurance. They said the refund amount was small, so I filed a complaint. Thanks to the well-prepared documents, I got it within a month."

As so-called ‘complaint brokers,’ companies specializing in insurance dispute complaints, have proliferated, insurance complaints have surged.

Previously, most cases involved helping clients get higher traffic accident settlement amounts, but recently, some have shamelessly promoted that consumers can receive a full refund upon canceling dollar insurance, citing consumer warnings issued by financial authorities. The consumer warnings are being exploited as a sales point by complaint agencies.

According to the insurance industry on the 14th, complaint agencies are recruiting insurance subscribers (complainants) by posting provocative phrases such as ‘100% insurance refund’ and ‘full refund’ on online blogs, cafes, and social networking services (SNS).

They approach subscribers who contact them after seeing promotional posts and provide complaint forms suitable for their cases to conduct consultations. Subscribers fill out these forms and submit them to the Financial Supervisory Service, and the received complaints are immediately notified to the respective insurance companies.

The complaints mainly involve claims of incomplete sales, such as ‘the agent’s explanation differed from the product details’ or ‘the subscription form signature was forged.’ Ultimately, the insurance company refunds the insurance money, the agency receives a consulting initiation fee, and if the complaint is accepted, they receive a success fee of 10-15% of the refund amount, engaging in illegal business practices.

Independent loss adjusters specializing in automobile insurance claims are representative of those providing complaint agency services. They reportedly approach accident victims by claiming to be former employees of major non-life insurance companies’ claims departments and promise to help them get higher settlement amounts.

Despite Encouraging Complaint Agency Use... Insurers Say "We Can't Refuse"

Insurance companies lament that they have no practical way to distinguish whether complaints are legitimately filed by consumers or if refunds are being demanded through agencies, forcing them to resolve complaints reluctantly.

A representative from a non-life insurer said, "Loss adjusters are effectively conducting sales activities by introducing tips consumers should know, like how to get higher traffic accident settlements," adding, "Most brokers are former agents or insurance company employees, so ordinary consumers trust them because they possess specialized insurance knowledge and are familiar with internal insurance company matters."

The proportion of insurance-related complaints, which account for the highest share of financial complaints, continues to increase. The insurance industry consensus is that the rate of complaint growth is accelerating as complaint agencies increase.

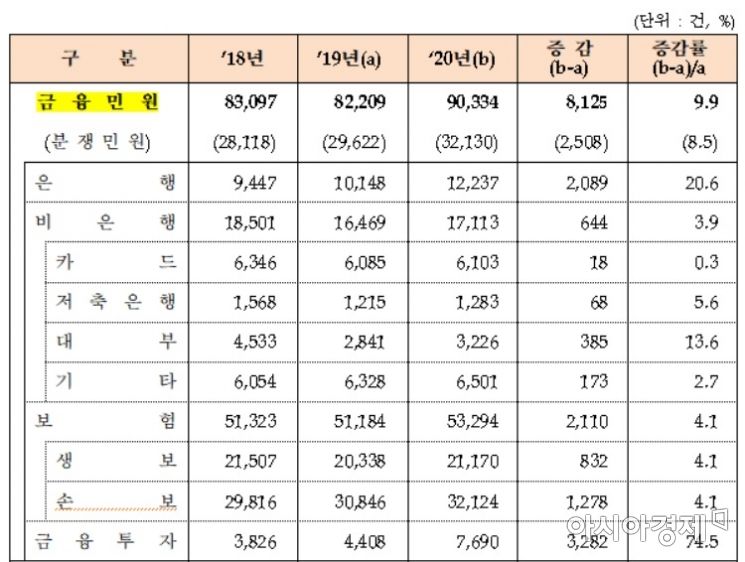

Last year, financial complaints recorded 90,334 cases, a 9.9% increase from 82,209 cases the previous year, with insurance complaints accounting for 53,294 cases, or 59% of all financial complaints. This means 6 out of 10 financial complaints are insurance-related.

Life insurance complaints accounted for 23.4%, and non-life insurance complaints 35.6%, with non-life insurance complaints being more prevalent. In particular, complaints related to incomplete sales, such as insufficient product explanations, against life insurers increased by 23.0% year-on-year to 9,663 cases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)