ESG Management a Global Hot Topic...Global Credit Rating Agencies Reflect ESG Capabilities

Strengthening Sustainable Management and Social Responsibility

[Asia Economy Reporter Lee Kwang-ho] As ESG (Environmental, Social, and Governance) management has become a global hot topic, financial companies are rushing to issue ESG bonds. This is because they can simultaneously strengthen sustainable management and social responsibility while securing various foreign currency funds at reasonable costs.

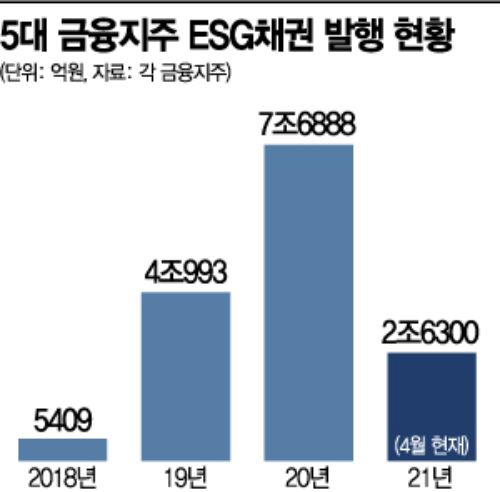

According to the financial sector on the 13th, the total amount of ESG bonds issued by the five major financial holding companies?KB, Shinhan, Hana, Woori, and NH Nonghyup?from January to April this year reached 2.63 trillion KRW, a 59.2% increase compared to 1.0723 trillion KRW a year ago. This accounts for 34.3% of the ESG bonds issued throughout last year (7.6888 trillion KRW).

Shinhan Financial issued ESG bonds worth 850 billion KRW, followed by Hana Financial (760 billion KRW), KB Financial (710 billion KRW), Woori Financial (200 billion KRW), and Nonghyup Financial (110 billion KRW). Notably, Woori Financial issued ESG bonds for the first time since its holding company was established on the 31st of last month.

ESG bonds refer to special-purpose bonds where the issuing institution promises to use the raised funds for projects that create environmental or social value. They are similar to general bonds in that they can be raised through public or private offerings and are classified as senior or subordinated bonds or hybrid capital securities (perpetual bonds) depending on the repayment priority. However, they are categorized into green bonds, social bonds, and sustainable bonds based on their intended use.

9.8 Trillion KRW in Sustainable Bonds Issued

Looking at the ESG bond issuance trends of the five major financial holding companies, there is a strong focus on sustainable bonds. Since 2018, green bonds issued amount to only 1.0587 trillion KRW, whereas sustainable bonds total 9.8132 trillion KRW, more than eight times higher. This is analyzed to be because, unlike green and social bonds which are designated for environmentally friendly or social value-creating projects respectively, sustainable bonds can be used for projects that are both environmentally friendly and socially valuable.

However, this year, green bonds are expected to increase due to the Moon Jae-in administration’s New Deal policy and the green economy initiatives of the Joe Biden administration in the United States. In fact, in the global market, the issuance proportion of green bonds overwhelmingly exceeds that of sustainable bonds. According to Bloomberg, a U.S. economic news agency, and the Korea Capital Market Institute, the size of green bonds issued globally last year was 175.2 billion USD (approximately 196.3992 trillion KRW), accounting for 63% of the entire ESG bond market.

A financial sector official said, "The reason the financial sector is focusing on ESG is that the era of discussing corporate success and performance solely based on sales or profits has passed," adding, "Financial consumers also tend to rate financial companies practicing ESG more highly and actually use their services more." He continued, "Issuing ESG bonds can instill an image of strengthening sustainable management, improve the BIS (Bank for International Settlements) capital adequacy ratio through fund procurement, and receive favorable evaluations from global credit rating agencies and institutional investors." Recently, global credit rating agencies such as Moody’s and S&P have started reflecting ESG capabilities in their credit ratings.

Professor Sung Tae-yoon of Yonsei University’s Department of Economics said, "The financial sector’s leadership in issuing ESG bonds aligns with the global trend of considering the environment and sustainability," and added, "ESG bond issuance in the financial sector is expected to increase significantly this year, but the issued bonds should be linked to ESG to create a synergy effect, not just serve as an ESG tool."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.