Extension of Draft Fund Application Deadline Until Year-End

[Asia Economy Reporter Park Sun-mi] The government and financial authorities have decided to maintain the eligibility criteria for applying for the Industrial Stabilization Fund and only extend the deadline until the end of the year. Although there were discussions about expanding the eligibility criteria due to concerns that the fund's threshold was too high and its effectiveness was limited, they ultimately decided to stick with the existing plan. As a result, it is expected that the number of companies eligible for support in the future will remain limited.

According to the financial sector on the 13th, the application period for the Industrial Stabilization Fund, which was scheduled to end this month, will be extended until the end of the year. Considering the prolonged COVID-19 situation, the government and financial authorities plan to announce soon through detailed coordination that the application period will be extended until the end of the year.

Accordingly, the operation period of the support program for period industry partner companies, which was until the end of this month, is also likely to be extended until the end of the year. The financial authorities have been reviewing whether to extend the application deadline for the fund, which is due at the end of April, and whether there are ways for the fund to help companies rebound after COVID-19. The Ministry of Trade, Industry and Energy also reportedly suggested during a series of consultations with financial authorities that instead of operating the fund tightly, it would be necessary to consider expanding the supported industries to a broader range if there is demand.

However, during the discussions, the plan to lower the application threshold and expand the support target was not finally adopted. An official said, "The discussion was to extend only the period without relaxing the application requirements, and only final coordination with the government remains."

KRW 40 Trillion Scale but... Low Utilization Sparks Controversy

Given the potential controversy over the use of the Industrial Stabilization Fund, it is analyzed that the judgment was made to maintain the existing application criteria principles rather than providing indiscriminate support, and only extend the application deadline so that companies meeting the criteria can rebound amid the prolonged COVID-19 situation. As rumors circulated that the government and financial authorities were discussing easing the application criteria, some expected that Ssangyong Motor, which is facing a court receivership decision, might be included as a beneficiary of the fund.

With the decision to maintain the existing application criteria and only extend the deadline, controversy over the fund’s effectiveness due to low utilization is expected to continue.

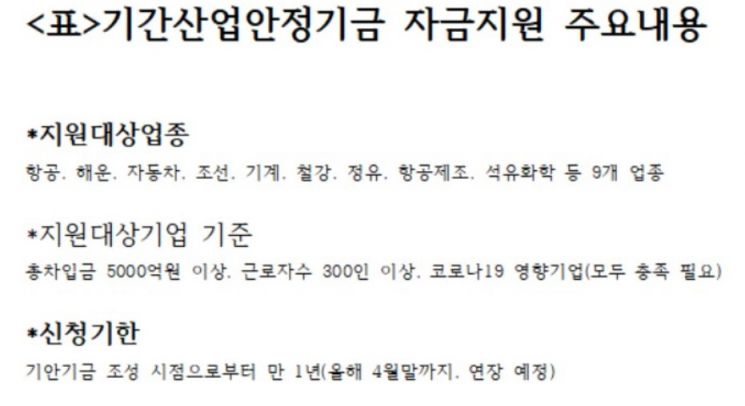

The Industrial Stabilization Fund was launched in April last year with a scale of KRW 40 trillion to provide necessary funds to companies in nine industries hit by COVID-19, including aviation, shipping, automobile, shipbuilding, machinery, steel, refining, aircraft manufacturing, and petrochemicals. So far, it has supported KRW 300 billion and KRW 32.1 billion to Asiana Airlines and Jeju Air respectively, and KRW 282.1 billion to period industry partner companies, totaling KRW 614 billion. This corresponds to a utilization rate of about 1.5%.

Support is only provided to period industries affected by COVID-19 with more than 300 employees and total borrowings exceeding KRW 500 billion, and the application must pass the review of the Industrial Stabilization Fund Review Committee, making the eligibility criteria very stringent and the application threshold too high, which has been criticized.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.