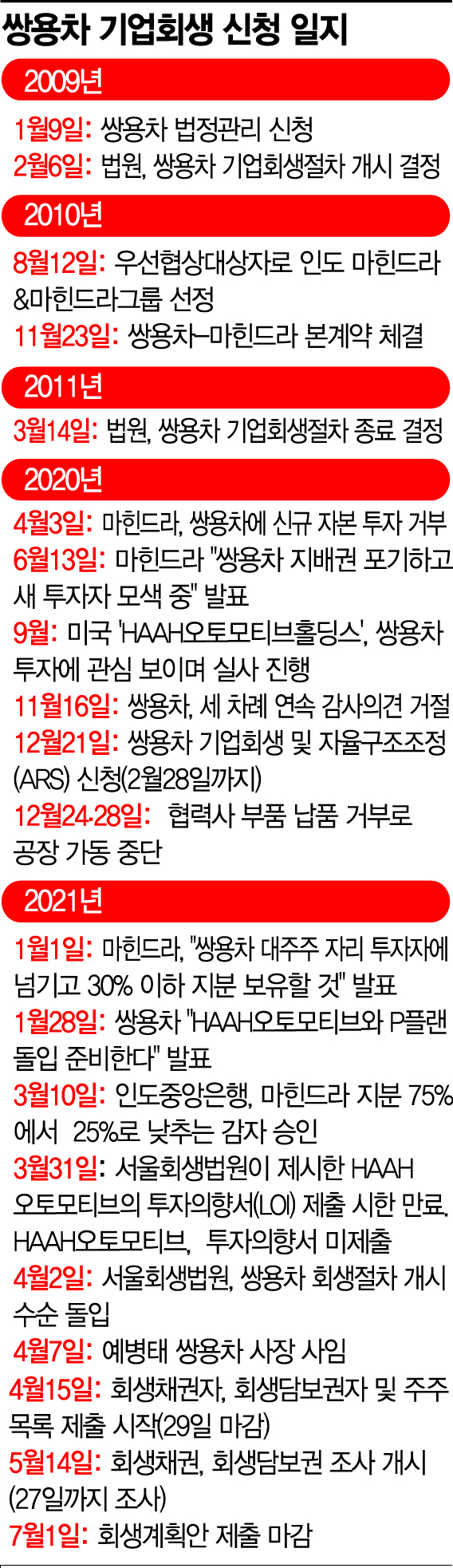

The revival of SsangYong Motor, which has entered rehabilitation proceedings (court receivership) for the first time in 12 years since 2009, depends on improving its going concern value and finding a new buyer. If the court determines at any stage of the rehabilitation process that SsangYong Motor's going concern value is lower than its liquidation value, it may issue a discretionary bankruptcy declaration.

SsangYong Motor Must Increase Going Concern Value... Industry Conditions Still Unfavorable

With the court initiating SsangYong Motor's rehabilitation proceedings, subsequent steps such as creditor claims registration, investigation committee review, submission of rehabilitation plans, and hearings and decisions on the rehabilitation plan will proceed. First, the investigation committee will evaluate SsangYong Motor’s debts, assets, and rehabilitation prospects through due diligence, comparing going concern value and liquidation value.

Just before the start of the rehabilitation proceedings, SsangYong Motor conducted an asset revaluation of its Pyeongtaek plant site to escape capital erosion. As a result, the book value of the Pyeongtaek plant site increased from KRW 402.57 billion to KRW 681.37 billion in the consolidated financial statements as of the end of last year. On the 13th, SsangYong Motor filed an objection to delisting with the Korea Exchange.

However, to secure liquidity independently, SsangYong Motor urgently needs to increase sales volume by launching competitive new models. The first of these was the launch of the Rexton Sports & Khan on the 5th, but just three days later, on the 8th, production at the Pyeongtaek plant was halted until the 16th of this month due to semiconductor supply issues.

Because of this, financial institutions and industry insiders suggest that labor and management should significantly reduce wages to cut fixed costs until the company returns to profitability to secure its future. Last year, as the management crisis worsened, employees voluntarily deferred 20% of their wages as a form of reduction, but it is suggested that this practice should continue until the bankruptcy threat is overcome.

New Buyer Must Be Found During Rehabilitation Process

Although the SsangYong Motor creditors' council and others emphasize the importance of continuation considering the 20,000 jobs related to SsangYong Motor, the liquidation value currently exceeds the going concern value. Even though SsangYong Motor has escaped capital erosion, it still has significant liabilities, including KRW 370 billion in public claims and other current liabilities. The industry estimates that about KRW 1 trillion in funding will be needed long-term to normalize SsangYong Motor.

Accordingly, it is expected that the court will proceed with the process by securing new investors through mergers and acquisitions (M&A) before approving the rehabilitation plan and creating a plan that reflects investment plans such as capital increases. If the court conducts a public sale, HAAH Automotive, a major potential investor, is also expected to participate in the bidding.

Domestic electric bus manufacturer Edison Motors, electric vehicle company K-Pop Motors, and private equity affiliate Park Seokjeon & Company have expressed interest in acquiring SsangYong Motor. Industry and academic experts predict, "Only companies that can continuously invest in SsangYong Motor and have a sales network will have a chance in the bidding."

Some also consider the option of splitting and selling major business units, as was done in the past with Korea GM. When Daewoo Motors entered court receivership in November 2000, its passenger car division was sold to GM in 2002, and its bus division was sold to Young An Motors in March 2003. The bus division was later acquired by Tata Daewoo in 2004.

However, unlike the Daewoo Motors case, SsangYong Motor only produces and sells sport utility vehicles (SUVs), and the large number of related employees makes this option less realistic. Professor Kim Pilsoo of Daelim University’s Department of Automotive Studies said, "SsangYong Motor currently has no surplus assets to dispose of," adding, "Since the related workforce reaches 20,000, it is unlikely that the court will decide to dismantle SsangYong Motor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.