[Asia Economy, reporter Park Jihwan] Due to the expiration of the Safe Conversion Loan for Ordinary Citizens and other factors, the issuance of asset-backed securities (ABS) in the first quarter of this year dropped by nearly 40% compared to last year. ABS refers to securities issued based on assets that are difficult to convert into cash immediately, such as real estate, accounts receivable, and mortgage-backed loans. Companies and financial institutions use ABS as a means to secure liquidity early.

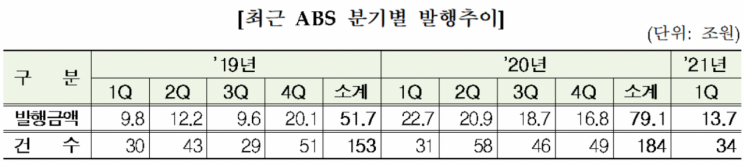

According to the "Analysis of ABS Registration and Issuance Performance for the First Quarter" released by the Financial Supervisory Service on April 13, 2021, the total ABS issuance in the first quarter of this year was 13.7 trillion won, a decrease of 9 trillion won (39.7%) compared to the same period last year. The decrease in issuance this quarter was mainly due to a reduction in the issuance of mortgage-backed securities (MBS) by the Korea Housing Finance Corporation.

Since the third quarter of 2019, the government has introduced the Safe Conversion Loan for Ordinary Citizens, which allows borrowers to switch from variable-rate mortgage loans to low-interest, fixed-rate mortgage loans. As a result, last year's MBS issuance totaled 48.6 trillion won, an increase of 20.5 trillion won compared to 28.1 trillion won the previous year. However, in the first quarter of this year, only 9.1 trillion won was issued, a 49.2% decrease compared to 17.9 trillion won in the first quarter of last year. An official from the Financial Supervisory Service explained, "Following the policy effects of the Safe Conversion Loan for Ordinary Citizens, the issuance amount surged in the fourth quarter of 2019 and the first quarter of 2020, but has been declining since then."

Financial companies issued 2.2 trillion won in ABS, an increase of 100 billion won compared to the same period last year. Specifically, banks issued 500 billion won in ABS backed by non-performing loans (NPLs); specialized credit finance companies issued 1 trillion won in ABS backed by installment finance receivables and similar assets; and securities companies issued 700 billion won in primary collateralized bond obligations (P-CBOs) backed by corporate bonds of small and medium-sized enterprises. During the same period, general corporations issued 2.4 trillion won in ABS backed by installment payments for mobile devices and real estate project financing, a decrease of 300 billion won (10.8%).

In particular, securities companies newly issued 700 billion won in asset-backed securities (P-CBOs) based on corporate bonds in the first quarter, specifically to support overcoming the impact of COVID-19. As of the end of March this year, the total outstanding balance of ABS stood at 221.1 trillion won, an increase of 2.1 trillion won (1.0%) compared to the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.