National Pension Service Sold Net 16.6 Trillion Won This Year, Expected to Reduce Sales

Top Sold Stocks Samsung Electronics, LG Chem, SK Hynix See Rising Benefit Expectations

Foreign Investors Also Returning... Stock Market Rebound Possible

[Asia Economy Reporter Minwoo Lee] The National Pension Service (NPS), which has consistently been a net seller in the KOSPI market this year except for just two trading days, is expected to halt its selling spree. Even if it does not immediately switch to buying, the stocks that have been heavily sold are anticipated to benefit.

According to the financial investment industry on the 12th, the NPS Fund Management Committee has increased the allowable deviation range for strategic asset allocation (SAA) in domestic stocks from ±2 percentage points to ±3 percentage points. As a result, while the target weight for domestic stocks remains at 16.8% until the end of the year, the expanded SAA tolerance allows the weight to increase up to 19.8%.

Earlier, pension funds including the NPS had net sold 16.6865 trillion KRW worth of stocks in the KOSPI market through the 9th of this month. Except for net purchases of 85.1 billion KRW on the 15th and 110.5 billion KRW on the 16th of last month, they have been net sellers throughout the year. With this Fund Management Committee decision, although an immediate shift to buying is not expected, the scale of selling can be reduced.

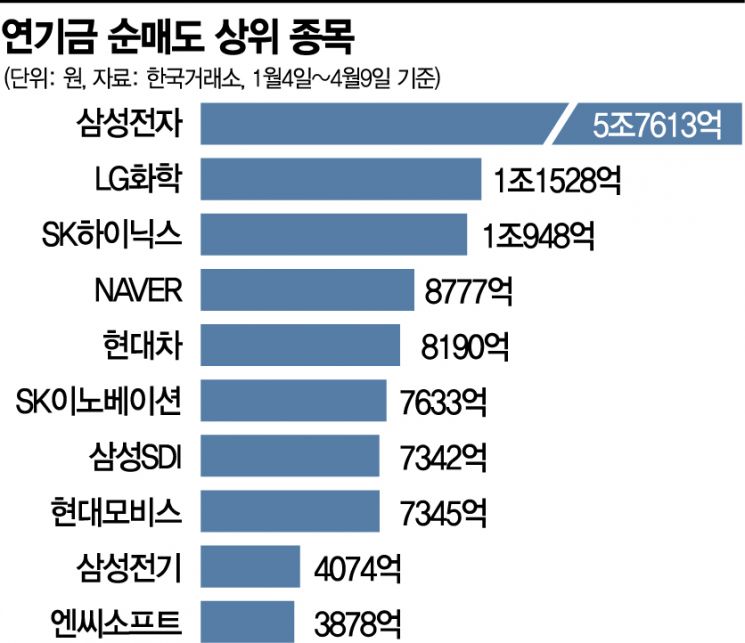

The stock most heavily net sold by the NPS this year was Samsung Electronics. Through the 9th, it sold a total of 5.7613 trillion KRW. LG Chem (1.1528 trillion KRW), SK Hynix (1.0948 trillion KRW), and others also saw net sales exceeding one trillion KRW. Additionally, NAVER (877.7 billion KRW), Hyundai Motor (819 billion KRW), SK Innovation (763.3 billion KRW), Samsung SDI (734.2 billion KRW), and several other stocks were sold off by more than 500 billion KRW each.

Since most of these stocks are growth value stocks in sectors such as semiconductors, secondary batteries, and internet platforms, the easing of selling pressure is expected to lead to a rebound that could drive the KOSPI’s upward trend. This is due to expectations that it could resolve the current absence of leading stocks in the domestic market. Daeseok Kang, a researcher at Eugene Investment & Securities, explained, "Since the COVID-19 pandemic, sectors like secondary batteries, internet, and gaming, which played a leading role in the domestic stock market, have continued to underperform despite the stabilization of the rapid rise in interest rates. Last week, a clear strength in small- and mid-cap stocks reemerged," adding, "Semiconductor and automobile stocks also struggled to gain momentum."

Foreign investors turning to net inflows for the first time in five months is also bolstering expectations for a market rebound. Recently, foreign investors have been net buyers in sectors such as semiconductors, internet, secondary batteries, and automobiles. Kyungmin Lee, a researcher at Daishin Securities, said, "With IT, renewable energy-focused manufacturing companies, and internet companies dominating the top market capitalization in KOSPI, the strengthened expectations for global economic and trade recovery are factors changing foreign investors’ perspectives," and predicted, "Gradual expansion of foreign buying centered on existing leading stocks is expected."

Seun Hwang, a research fellow at the Korea Capital Market Institute, stated, "The overlap between sectors where foreigners are increasing purchases and those where pension funds are expected to reduce sales is clearly positive news for the domestic stock market in the short term," but cautioned, "However, if the NPS increases its domestic stock allocation, the current market participants, especially the older generation with substantial funds, will benefit. When it comes time to sell stocks to pay pensions to the current 20s and 30s generation, the burden on future generations could increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.