[Asia Economy Reporter Byunghee Park] It has been confirmed that the compensation of CEOs of major U.S. corporations increased last year despite the economic downturn and massive unemployment caused by the COVID-19 pandemic.

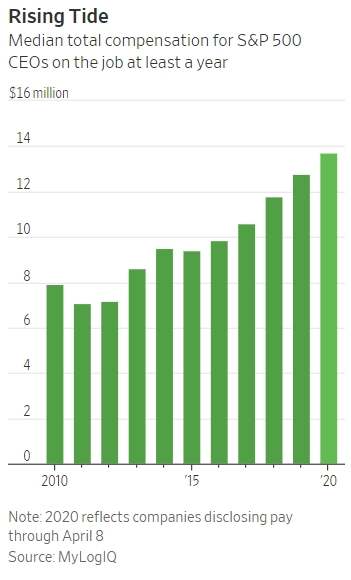

The Wall Street Journal (WSJ) reported on the 11th (local time) that an analysis of 322 companies included in the S&P 500 index showed that the median CEO compensation last year was $13.72 million. This represents a 7% increase from $12.77 million in 2019, marking an all-time high. The median CEO compensation has risen for five consecutive years after dropping from $9.53 million in 2014 to $9.43 million in 2015. Among the 322 companies, CEO compensation increased in 206 companies. The average increase rate for companies with higher compensation was 15%.

Although many CEOs gave up part or all of their salaries due to COVID-19, it had little impact. This was because they received compensation in stocks such as dividends and stock options thanks to rising stock prices. Salary accounts for less than 10% of CEO compensation, with most being stock compensation and cash bonuses. Larry Culp, CEO of General Electric (GE), gave up a salary of $653,409 last year but earned $73.2 million in total compensation. This was due to contract extensions and newly adjusted performance targets.

Some companies adjusted performance targets considering the COVID-19 situation, thereby securing the pockets of their executives. The stated reason was to retain proven management personnel.

Norwegian Cruise Line Holdings recorded a $4 billion loss last year but doubled CEO Frank Del Rio’s compensation. CEO Del Rio received $36.4 million, including bonuses related to a three-year contract extension. A Norwegian spokesperson stated that the company took cost-cutting measures but explained that Del Rio, with his professional expertise, was necessary for the company during the difficult pandemic situation.

The increase in CEO compensation amid the poor economic situation due to COVID-19 faced strong opposition from shareholders. At shareholder meetings of Starbucks, Walgreens Boots Alliance, and others, CEO compensation proposals failed to gain shareholder approval.

Since September 1 last year, it was confirmed that the proportion of companies with less than 70% approval rates for compensation proposals at shareholder meetings was one in six. Compared to the same period in 2019, when the proportion of companies with less than 70% approval was one in twelve, opposition has significantly increased.

Don Delves of Willis Towers Watson, an insurance and pension consulting firm, said, "An approval rate below 70% is effectively considered a rejection."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.