Calls for Expanding Internet Bank Establishment Following Enforcement of the Financial Consumer Protection Act...

Accelerated Branch Reduction Amid Expansion of Banks' Non-Face-to-Face Services

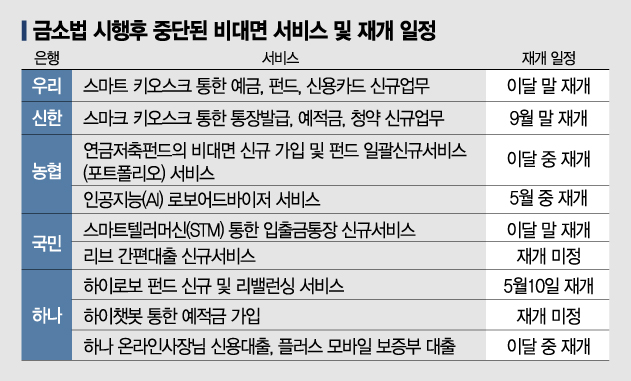

[Asia Economy Reporter Park Sun-mi] Some non-face-to-face financial services in the banking sector, which were temporarily suspended due to the construction of a computer system reflecting the Financial Consumer Protection Act (FCPA), will resume normal operation from the end of this month. With the enforcement of the FCPA, non-face-to-face sales of financial products are preferred over branch sales, and the atmosphere for expanding the establishment of internet-only banks is being created, increasing the likelihood that the already decreasing number of bank branches will shrink even faster in the future.

According to the banking sector on the 12th, Woori Bank plans to resume some services of the smart kiosk (unmanned terminal), which were temporarily suspended on the 25th of last month due to the enforcement of the FCPA, by the end of this month. Woori Bank stopped new transactions such as deposits, funds, and credit cards through kiosks due to the construction of a computer system applying the contents of the FCPA. The system construction work is currently underway, and normal service operation will be possible from the end of this month.

Hana Bank will also resume some suspended services this month, including Hana Online Sajangnim credit loans and Plus mobile guaranteed loans, which are non-face-to-face exclusive products. The Hi Robo Fund new and rebalancing services are scheduled to operate normally from the 10th of next month. The resumption date for subscription to savings and deposits through the Hi Chatbot has not yet been decided.

In the case of Kookmin Bank, new deposit and withdrawal account services through the Smart Teller Machine (STM) will be provided again from the end of this month. Earlier, Shinhan Bank has been accepting applications for some loan products via internet banking, which were suspended due to the enforcement of the FCPA, normally since last week. However, the resumption of new account issuance, savings and deposits, and subscription services through smart kiosks has been postponed to the end of September.

NongHyup Bank will also resume non-face-to-face new subscriptions for pension savings funds and the fund batch new subscription service (portfolio), which allows multiple funds to be subscribed to at once, this month after suspension due to the FCPA. Additionally, the artificial intelligence (AI) robo-advisor service is scheduled to resume operation from May.

Expanding Non-Face-to-Face Services

Bank Branch Reduction Also 'Ongoing'

As banks gradually normalize the non-face-to-face services temporarily suspended during the application of the FCPA, the pace of expansion of non-face-to-face services in the banking sector has accelerated further. The FCPA includes strict provisions from the seller's perspective, such as the ‘principle of legality,’ which requires recommending only products that reflect the customer's investment propensity. Since bank branches must provide detailed guidance from A to Z to avoid responsibility, it takes a lot of time, and it has become common to encourage customers visiting branches to subscribe non-face-to-face.

A bank official explained, "After the enforcement of the FCPA, confusion occurred on-site, so customers are encouraged to subscribe to products through the bank application (app) whenever possible," adding, "Even if account opening is done at the branch, time-consuming tasks such as investment propensity analysis are encouraged to be processed non-face-to-face."

Since the four major financial holding companies are interested in establishing independent internet-only banks, the expansion of non-face-to-face channels for financial services is likely to accelerate further. This means that traditional financial services conducted at bank branches are gradually losing their place.

In fact, although financial authorities have put brakes on bank branch reductions by mandating ‘prior impact assessments before closure,’ the banking sector expects the atmosphere of offline branch consolidation and consequent reduction in the number of branches to continue due to the enforcement of the FCPA and the strengthened need for internet-only banks. As of the end of last year, the number of domestic bank branches was 6,406, a decrease of 304 from the previous year (6,709). This is the largest decline since 2017 (312 branches).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.