Household Debt Growth Rate in the 8% Range to Drop to 4% Range Next Year

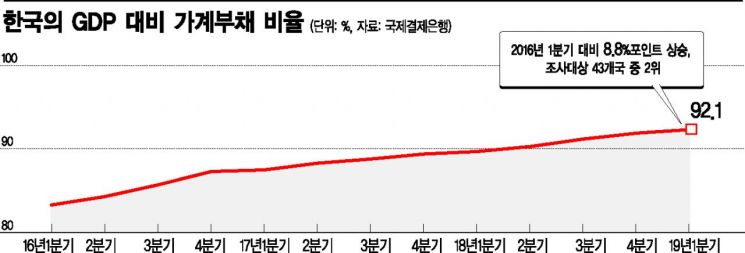

[Asia Economy Reporter Oh Hyung-gil] Financial authorities have set a plan to reduce the household debt growth rate, currently in the 8% range, to the 4% range next year.

This means managing household debt under a long-term perspective to prevent the rapidly increasing household debt from becoming a burden on the economy.

According to financial authorities on the 11th, the household debt growth rate, which had been declining, expanded during last year's COVID-19 pandemic.

The household debt growth rate steadily decreased from 11.6% in 2016, 8.1% in 2017, 5.9% in 2018, to 4.1% in 2019.

Last year, the household debt growth rate surged to the 8% range due to measures taken in response to COVID-19.

Accordingly, financial authorities set a goal to restore the household debt growth rate to the 4% range, the level before the COVID-19 outbreak in 2019.

Since rapidly reducing the growth rate could also be burdensome, the plan is to first reduce it to a certain level this year and then bring it down to the 4% range next year.

Of course, this plan assumes that the COVID-19 situation will calm down and economic normalization will be achieved.

A financial authority official said, "Since the household debt growth rate at the end of last year was in the 8% range, it should not rise to 9-10%, so we need to prepare in advance," adding, "It would be too late to manage it after the COVID-19 situation settles."

The household debt management plan to be announced by financial authorities later this month will include specific measures to gradually control the growth rate.

One method under consideration is gradually expanding the application of the Debt Service Ratio (DSR) 40% limit by borrower.

DSR is an indicator that calculates the principal and interest repayment burden on all loans of a borrower during loan screening.

Currently, since only the average per bank (DSR 40%) needs to be met, some borrowers receive loans exceeding a DSR of 40%, and the plan aims to prevent this.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.