U.S. President Joe Biden is holding a semiconductor chip and explaining the purpose of the executive order on building a semiconductor supply chain before signing the order at the White House last February. (Washington EPA=Yonhap News)

U.S. President Joe Biden is holding a semiconductor chip and explaining the purpose of the executive order on building a semiconductor supply chain before signing the order at the White House last February. (Washington EPA=Yonhap News)

[Asia Economy Reporter Kim Heung-soon] Major countries such as the United States and China are accelerating 'self-reliance' backed by government support to seize leadership in the semiconductor industry, which is facing a global supply shortage crisis. The domestic semiconductor industry, feeling the urgency, has also demanded government support as essential to strengthen competitiveness through talent development and expanded incentives.

"Securing Competitive Advantage in the Semiconductor Market"

US Biden Administration's Support Measures in Full Swing

According to KOTRA on the 10th, the US Congress enacted the Semiconductor Manufacturing Incentives Act in June last year to support investments in semiconductor manufacturing facilities and basic research and development (R&D). In July, the US passed the Foundry Act, and in January this year, it enacted a bill demanding federal incentives for chip manufacturing and semiconductor research investments within the US to meet the increasing semiconductor demand. Through these measures, the US expects to strengthen leadership in the semiconductor sector, rebuild the economy, create jobs, and enhance the resilience of semiconductor supply chains.

With the inauguration of the Joe Biden administration, plans were also announced to promote advanced technology industries including semiconductors. Representative measures include providing investments and incentives for R&D, manufacturing capabilities, and securing supply chains required for semiconductor component production. Additionally, the administration aims to promote reshoring to protect domestic policies by enhancing the international competitiveness of US-made products and technologies across manufacturing and securing stable supply chains.

The White House is scheduled to host a virtual CEO summit on semiconductors and supply chain restoration on the 12th (local time), which is also seen as part of the movement toward semiconductor self-reliance. The summit is expected to be attended by 19 companies including Samsung Electronics, the world’s No.1 in memory semiconductors, Taiwan’s TSMC, the No.1 in the foundry market, as well as semiconductor, automotive, and tech companies.

Not only the US but China is also pushing a government-led investment plan worth approximately 170 trillion won under the goal of raising semiconductor self-sufficiency to 70% by 2025. The European Union (EU) is also implementing strong semiconductor incentive policies, supporting semiconductor manufacturing technology development projects worth over 67 trillion won as the need for semiconductor self-reliance grows worldwide.

Domestic Semiconductor Industry: "Urgent Need for Talent Development, Manufacturing Incentives, and Trade Support"

Requesting the Government to Enact a "Special Act"

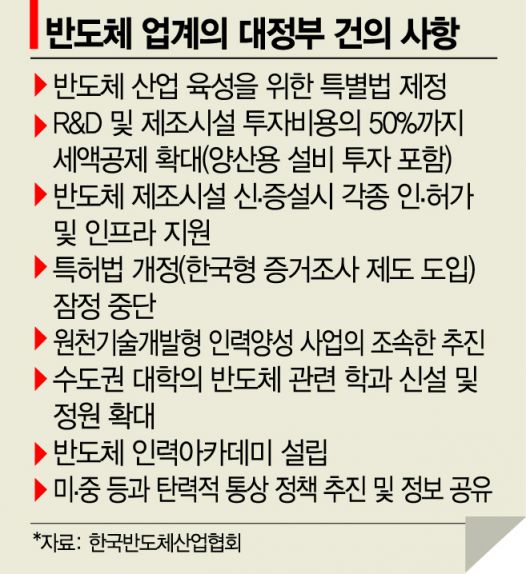

On the 9th, the Korea Semiconductor Industry Association requested the government in a meeting chaired by Minister Sung Yun-mo of the Ministry of Trade, Industry and Energy to expand tax credit incentives for manufacturing facility construction, nurture and supply excellent talent, stabilize the domestic semiconductor supply chain, and provide trade support aligned with rapidly changing international circumstances. Facing a situation where semiconductor self-reliance has escalated into a geopolitical power struggle, the domestic semiconductor industry, which must compete for survival with global companies, requested concrete government support measures.

The most discussed topic was talent development. The Semiconductor Association proposed expanding science and engineering personnel by establishing new semiconductor-related departments and increasing enrollment in metropolitan universities, as well as creating and expanding semiconductor-related computer and software (SW) departments. They also urged the prompt implementation of the 'Source Technology Development Talent Training Project' targeting graduate students in master's and doctoral programs to cultivate research personnel. Establishing a 'Semiconductor Talent Academy' specializing in practical training to supplement the manpower shortage in small and medium semiconductor companies was also suggested as an alternative.

Additionally, they proposed incentive measures to expand tax credits up to 50% of R&D and manufacturing facility investment costs and emphasized the need to pursue international trade policies that allow domestic semiconductor companies to focus on stable business operations. Furthermore, considering that the semiconductor industry requires cross-governmental support and faces competition with global companies rather than just domestic ones, they stressed the urgency of enacting a 'Special Act for Semiconductor Industry Promotion' to enhance the speed and effectiveness of policies.

A semiconductor expert, in an interview with KOTRA Silicon Valley Trade Office, stated, "The active movement toward semiconductor self-reliance in countries including the US could pose a long-term threat to domestic semiconductor companies and materials, parts, and equipment companies. To maintain competitiveness in technology, it is necessary to continuously strengthen the technological foundation while investing to increase self-sufficiency in materials and equipment."

He also pointed out, "Domestic semiconductor companies and 'SoBuJang' (materials, parts, and equipment) companies need to establish a strategy to diversify demand sources." KOTRA added, "Proactive measures should be prepared to discover new cooperation channels between semiconductor demand companies and manufacturers and secure core technologies to improve semiconductor productivity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.