"Key Variables May Highlight the Strength of US Economic Recovery and Differentiation in Monetary Policy"

[Asia Economy Reporter Kim Eunbyeol] This year, as long-term U.S. Treasury yields rose, an 'inflation tantrum' appeared in the international financial market, but emerging market currencies showed a resilient trend, according to an analysis.

The International Finance Center analyzed this in its report titled 'The Impact of the Global Bond Tantrum on the International Foreign Exchange Market,' released on the 9th. Compared to past bond market tantrums in the international financial market, the tantrum triggered by inflation concerns in February to March this year had a more limited impact on emerging market currencies.

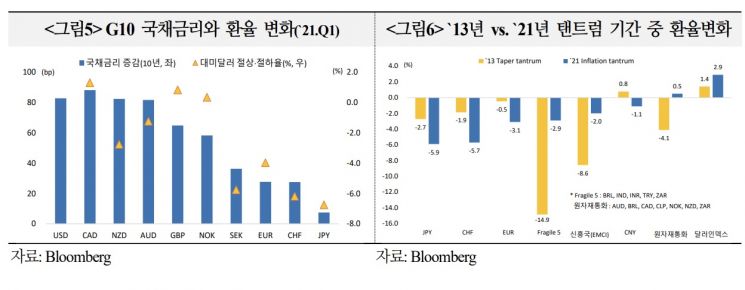

The center explained that a comparative analysis of interest rates, exchange rates, and stock price changes during the 2013 Taper Tantrum, the 2015 Bund Tantrum, the 2016 Trump Tantrum, and this year's inflation tantrum showed that emerging market and commodity currencies exhibited a resilient trend this year.

In 2013, emerging market currencies sharply depreciated. At that time, currencies of Brazil, Turkey, India, Indonesia, and South Africa, which had weak fundamentals, depreciated by about 15%, and the emerging market currency index also plunged by 8.6%. In contrast, during this year's inflation tantrum, the emerging market currency index fell by only 2.0%.

Researcher Kwon Dohyun of the International Finance Center explained, "While major advanced country currencies weakened due to the widening interest rate differential with the U.S., the concurrent global economic recovery, improvement in emerging market external soundness, and the Federal Reserve's accommodative stance supported emerging market currencies." Additionally, the stable trend of the Chinese economy was also cited as a factor supporting emerging market currencies.

Researcher Kwon also stated, "During February to March, as the U.S. economic recovery accelerated and inflation concerns arose, the tantrum occurred, and the U.S. dollar shifted to a strong trend. The dollar had been weakening amid the global reflation trend but reversed to strength along with the rebound in U.S. real interest rates."

The International Finance Center noted that the recent bond market tantrum and the dollar's strengthening trend are somewhat calming down, and the prevailing view is that the strong trend will weaken going forward. However, they forecasted, "The strength of the U.S. economic recovery and the potential highlighting of monetary policy differentiation will be key variables."

Regarding the impact on emerging markets, they said, "The concurrent global economic recovery and overall improvement in emerging market soundness are factors that enhance the resilience of emerging market currencies," but added, "As the Fed's monetary policy normalization issue intensifies, there is a possibility of increased risks of currency depreciation and capital outflows in the second half of this year or next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.